CTH23 85.50 (+0.13)

CTK23 85.94 (-0.06)

CTN23 86.45 (-0.19)

CTZ23 85.27 (-0.03)

Zhengzhou WQK23 – 14,805 (-5)

Cotlook “A” Index – 100.95 (+2.15) – 8th February

Daily volume – 66,937

AWP – 75.24

Open interest – 207,843

Certificated stock – 1,147

H23 / K23 spread – (-0.44)

K23 / N23 spread – (-0.51)

N23 / Z23 spread – (+1.18)

March Options Expiry – 10th February 2023

March 1st Notice Day – 22nd February 2023

Introduction

– Before any comments on the market, our hearts are with all of those impacted by the terrible earthquakes in Turkey. In common with many of our readers we have dear friends in the impacted region and our thoughts go out to them all.

– Market action has been dominated by the ongoing funds roll this week, which at least means something is happening! In outright futures trading the front month March ’23 contract (which will likely be surpassed in open interest and, therefore, replaced as the lead month by May ’23 as soon as tomorrow) has traded in an ever narrower band, with today marking the third day in a row it closed in with an 85 handle. Today’s close was at 85.50, following 85.37 yesterday and 85.63 on Tuesday.

– Crass as it may seem given the humanitarian aspect it beholds us to look at the impact of the events in Turkey on the cotton market. The earthquake hit the centre of the Turkish textile industry and also the South East Anatolia production region, which can account for up to 60% of the Turkish crop (see below map). Prior to the disaster there was as much as 700,000 MT of Turkish cotton unsold in country and, this may well have to find a home on the international market in due course.

– Whilst it is far too early to assess the damage to the industry, significant disruption lies ahead. Even once the business of reconstruction is able to get underway and mills are able to restart their operations, there will still be significant issues caused be the wider damage in the area. It is likely to be some time before we see mills back to full operations and we should expect to see significant downward adjustments to Turkish consumption going forward.

– Finally, the USDA shows outstanding sales to Turkey for the current crop year of around 850,000 bales. Performance is, of course, likely to be all but impossible for many mills. The coming weeks and months are likely to see many cancellations and rolls on the export sales report and this cotton will find its way back on to merchants’ offering lists.

– Pakistan arrivals have been reported as 4.76 million local weight bales up until the end of January, compared to 7.4 million bales at the same point last season. The USDA have Pakistan production just short of 5 million local bales and, at this pace, this would not seem an unreasonable expectation.

– The USDA released their February WASDE yesterday, which was a pretty uneventful affair. The balance sheet was tightened with global ending stocks reduced by 850,000 bales. This came mainly due to cuts in production, notably by 1 million bales in India (which we believe is premature) and 610,000 bales in Francophone West Africa. These cuts were partially offset by an increase of ½ million bales in China.

– On the consumption side the USDA eased up on their recent (in our view correct) reductions in global consumption, making net cuts of only 190,000 bales worldwide. At EAP we continue to hold the view that the USDA have global consumption at least 5 million bales too high (and this is prior to credit related reductions that may come to bear in Pakistan and the reductions which will be sure to come in Turkey).

– The USDA export sales report based the week ending 2nd February were a marketing year high of 262,800 bales. However, this included 72,600 bales to Turkey which may well be in doubt following this week’s events. Other lead markets were once again China and Vietnam with 87,700 bales and 45,300 bales respectively. New crop sales remained slow at 4,800 bales and 210,100 bales were shipped for the week.

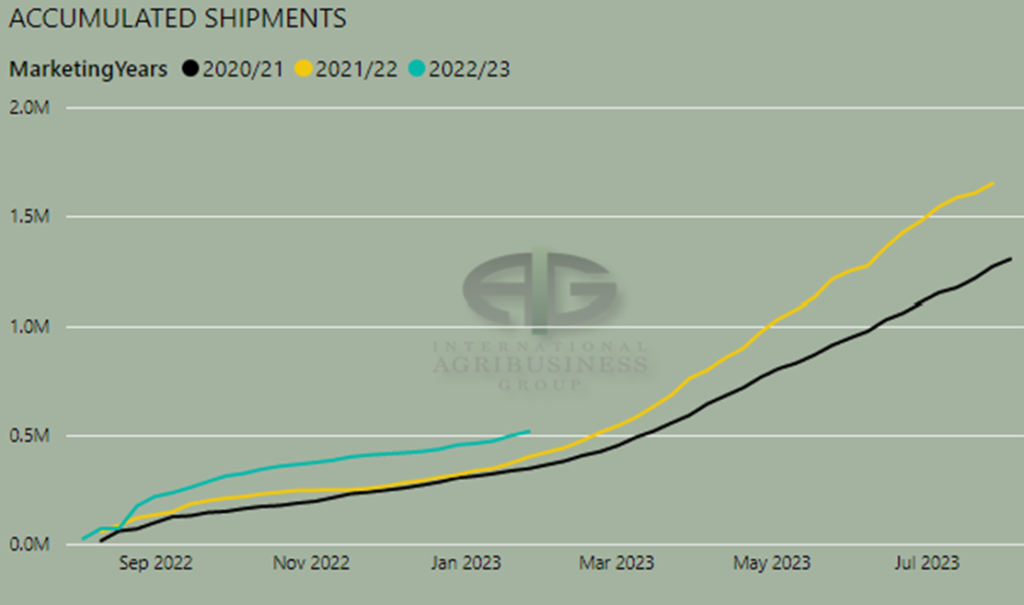

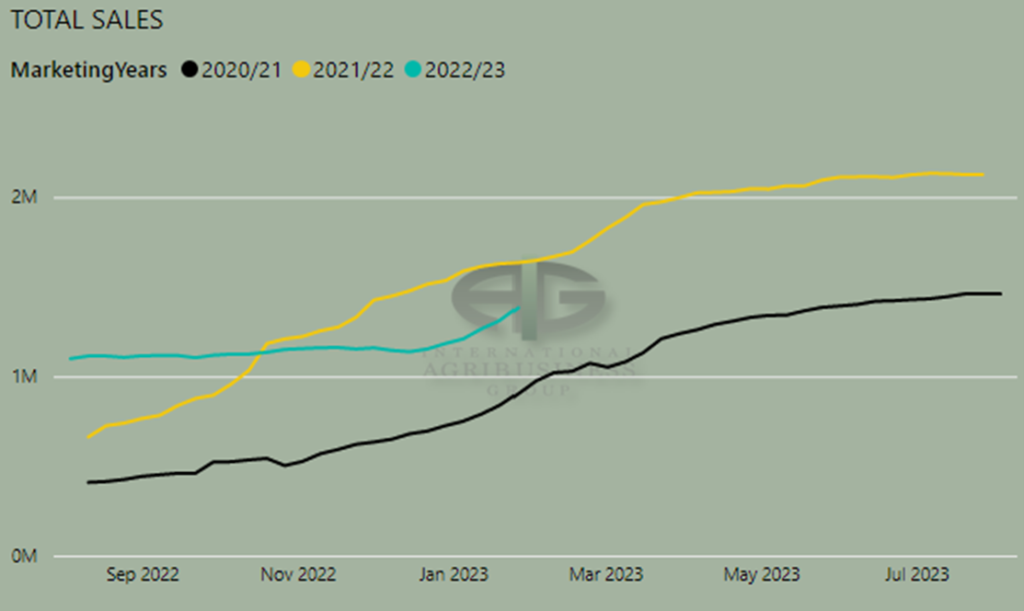

– The below charts, courtesy of our friend at IAG, show accumulated shipments and sales to Turkey.

– The CFTC cotton on call report based on positions as of 3rd February showed a net on call sales position for current crop of 32,501 contracts. This is a reduction of 1,702 contracts for the week and represents only the 11th highest position on record for this week of the year. One point of interest is the March on call purchases which, at 14,073 contracts, is the third highest on record for this week of the season and would suggest that there are some nervous producers out there!!!

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the high 80’s as fully valued and, for now, see any move for this contract into the low 90’s as a selling opportunity. The market remains plagued by a lack of demand though pockets of improvement are to be found in certain parts of the world such as India. A relatively wide trading range of say 75 to 95c/lb is likely to prevail to the end of the season ending May 31st.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.