CTH22 114.72 (-1.56)

CTK22 112.28 (-1.33)

CTN22 109.41 (-1.03)

CTZ22 93.99 (-0.31)

Zhengzhou CF205 – 20,960 (+25)

Cotlook “A” Index – 128.50 (+3.45) – 6th Jan

Daily volume – 22,180

AWP – 99.12

Open interest – 244,038

Certificated stock – 617

March/May spread – (+2.44)

March Options Expiry – 11th February 2022

March 1st Notice Day – 22nd February 2022

Introduction

– The ICE futures’ price break from the November seasonal highs to the nearby lows of 102.53 left three gaps in the chart (below). The old adage tells us that “gaps will be filled” and this has indeed proved true with the recent rally filling all three gaps and now entering a period of seeming consolidation with the lead month March ’22 closing today at 114.72 usc/lb, down 156 points for the day

– The latest Pakistan arrivals figure for December 31st recorded 7,347,404 local weight bales. This is an increase of only 179,286 bales on a month before and suggests that we are reaching the end of this season’s crop.

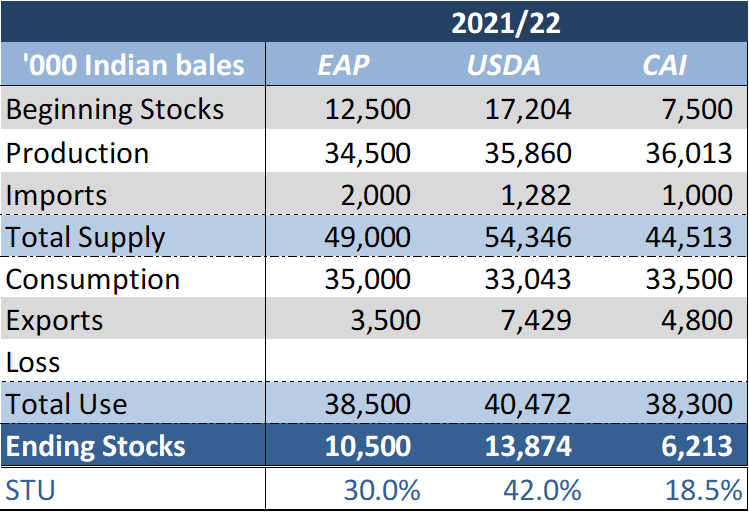

– During the Christmas period we have further tweaked our Indian SnD numbers (below in local weight bales). Notably our estimate of consumption now exceeds production. Nearby this enhances our belief that India will be a larger importer and smaller exporter than previously anticipated this season (though logistics constraints may tip some of these imports into the early part of the 22/23 season).

– The longer-term implications, should this situation persist, are perhaps even more interesting. EAP record Indian SnD estimates dating back to the 2010/11 season. In this period Indian consumption has never exceeded production. Taking the USDA as our guide, we have to go back to the 2002/03 season to find Indian production below consumption. For the intervening two decades India has predominantly been the supplier of last resort to the world. This situation could now be coming to an end, with significant ramifications to global trade flows as a once plentiful source of competitively priced cotton ceases to be freely available.

– There is, of course, scope for India to increase production and India’s record crop, recorded in 2013/14, was around 40 million local weight bales. However, in recent years India’s progress on yield seems to have stalled and production has struggled to exceed 37 million bales in the last seven years, whilst consumption has been on a consistent, upward trajectory. So, even in bumper crop years we are likely to see Indian production and consumption well balanced. Furthermore, India has on its doorstep the ever-expanding Bangladeshi market which will always look to its larger neighbour for nearby supplies, thus gobbling up the lion’s share of any cotton which India may export in the years to come.

– The CFTC Cotton-on-Call report, based positions as of 31st December, showed an overall increase in the current crop net on-call position of 1,375 contracts. Total net on call sales now stand at 104,034 contracts. For the first time in many months this is no longer the largest position for the calendar week, with the net position in the first week of 2018 being just over 600 contracts higher. However, the front month March ’22 position still remains the largest for the first week of the year with a net 41,489 contracts needing to be fixed.

– The USDA export sales report showed net sales of 143,200 bales for current crop and 44,000 bales for 2022/23 crop. China was the largest buyer of current crop with 47,000 bales whilst Pakistan was the largest overall buyer with a total of 61,300 bales (current crop 20,800 bales, 2022/23 crop 40,500 bales). Exports continue to fall far short of the pace required with 104,900 bales reported for the week.

Conclusion

Cotton has filled the upside gaps on the chart and may be entering a period of consolidation, before a subsequent move higher. We maintain the H22 high of 118.50 is likely to be exceeded before the season is over. EAP remain of the opinion that prices will stay in the 100’s for the rest of the season with the eventual seasonal high not expected until late February to early March 2022. A weaker Dollar Index and strong outside markets in the form of Soy, Corn and Wheat will be supportive to our short term friendly viewpoint. The one caveat to this would be a macro event that potentially causes all markets to collapse!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.