CTH23 86.39 (+0.78)

CTK23 87.10 (+0.76)

CTN23 87.72 (+0.79)

CTZ23 86.00 (+0.74)

Zhengzhou WQK23 – 15,150 (unch)

Cotlook “A” Index – 101.35 (-1.30) – 1st February

Daily volume – 38,879

AWP – 75.05

Open interest – 210,416

Certificated stock – 8,900

H23 / K23 spread – (-0.71)

K23 / N23 spread – (-0.62)

N23 / Z23 spread – (+1.72)

March Options Expiry – 10th February 2023

March 1st Notice Day – 22nd February 2023

Introduction

It has been a rather insipid week of trading (which is always helpful when one is on the road and doesn’t need to get caught out with surprises!). The lead month March ’23 closed today at 86.39 up 78 pts on the day. It is perhaps worth a repeat of the chart we posted a week ago (below), which shows the market trading in an increasingly narrow range.

– A delegation from EAP has been in Bangkok this week. Whilst the nation’s consumption is much reduced from its peak a number of strong, well run mills remain. Consumption is at around 700,000 bales a year in total.

– All of the mills we had the pleasure of meeting with were currently running at reduced capacity with around 60-70% of capacity usage seeming to be the consensus average for consumption.

– Mills report that sales in to the domestic market are returning a small margin whilst demand from the export market remains weak and below breakeven. This echoes reports from internationally driven markets where demand remains poor.

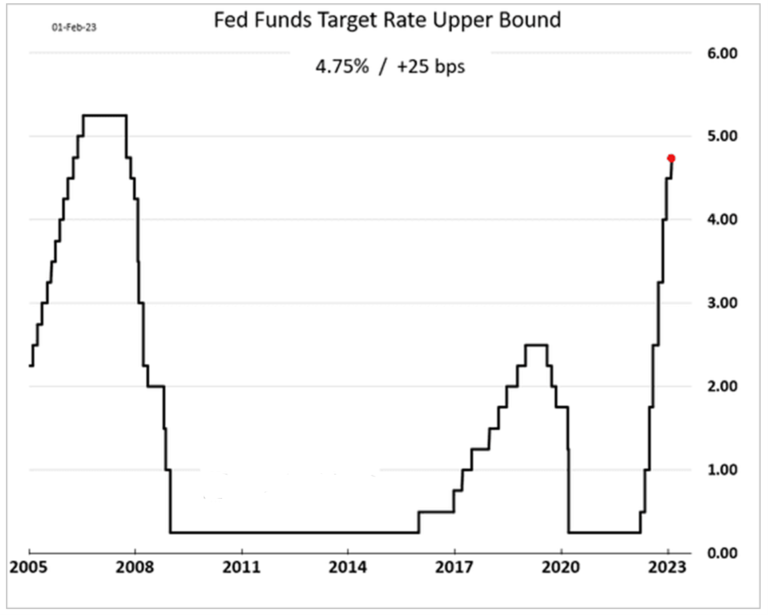

– The US Federal Reserve increased its benchmark interest rate by a quarter of a percentage point on Wednesday but warned “ongoing increases” would be needed to bring inflation under control. The news was well received by the markets, viewing it as a sign of less restrictive monetary policy to come, but it also augurs a slowdown or full recession to come.

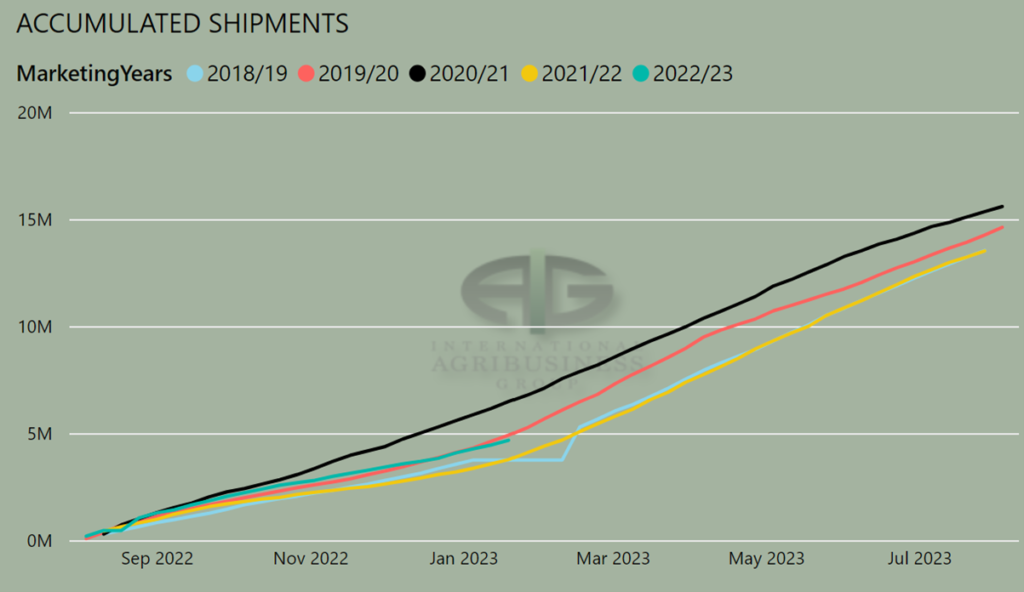

– The USDA export sales report based the week ending 26th January were down for the week, but still a respectable 171,200 bales. China dominated the sales this week, buying 119,800 bales. New crop sales picked up to 20,200 bales whilst exports were reported at 212,200 bales for the week.

– With regard to the CFTC cotton on call report, last week we commented, “very little to see here.”, but perhaps we should have waited a week! The total net change for current crop positions for the week was 24 contracts! The outright position remains the 11th highest for the week of the year and the on call position still remains to be a smaller influence on the market than in previous years

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the high 80’s as fully valued and, for now, see any move for this contract into the low 90’s as a selling opportunity. The market remains plagued by a lack of demand though pockets of improvement are to be found in certain parts of the world. A tightening of supply, notably in India, prompts us to raise our downside ideas to the mid to high 70s.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.