CTH22 103.70 (-0.49)

CTK22 102.40 (-0.37)

CTN22 100.48 (-0.19)

Zhengzhou CF201 – 20,535 (+310)

Cotlook “A” Index – 118.55 (-4.50) – 1st Dec

Daily volume – 38,784

AWP – 102.65

Open interest – 240,972

Certificated stock – 400

March/May spread – (+1.30)

March Options Expiry – 11th February 2022

March 1st Notice Day – 22nd February 2022

Introduction

– Since last Friday’s reversal ICE cotton has continued its decline with today marking the fifth consecutive day of losses. March ’22 broke recent front month lows of 103.50 dating back to October 13th setting a new low of 102.50, eventually closing at 103.70. This is 16 points below the recent low close of October 13th and just above the 50% retracement level of the recent move up from September.

– In China the CNCRC have this week suspended their domestic reserve release with the total volume released to date standing at around 1.2 MMT. With quotas and import availability dwindling it would appear that this is an attempt to support the domestic market and push mill buyers towards the more highly priced domestic cotton.

– Chinese new crop was sold this week at 22,600 RMB/MT (equivalent to 144.25 usc/lb on a CIF basis using a sliding-scale tax conversion or 160.75 usc/lb on a straight RMB to USD conversion), whilst old crop traded at 22,300 (142.25 usc/lb and 158.75 usc/lb).

– However, at these prices yarn margins are negative and it is being reported that stocks are beginning to build. 32 counts have traded in the last week at 29,000 RMB/MT. On our rough estimates the break even sale price for yarn based the above-mentioned cotton prices would stand at 31,300 RMB/MT and 31,000 RMB/MT respectively.

– Whilst the Chinese government’s aim may be to support the local market and channel demand towards domestic cotton, it would seem more likely that, absent an increase in yarn prices, yarn buyers will turn to the import market, bringing fresh demand for overseas spinning mills.

– A combination of the emergence of the Omicron Covid strain followed by the Fed’s pivot to a more hawkish inflation stance this week has brought pressure on all markets. Below is a selection of charts from a variety of markets (wheat, sugar, crude, copper and S&P 500) which show the widespread risk-off action from this week.

– The CFTC Cotton-on-Call report, based positions as of 26th November, showed a further decline in overall net on call positions, though this time with a small decline (1,274 contracts) in the March ’22 position. The unfixed on call position remains remarkably high with the overall current crop net position standing at 114,828 contracts and the March ’22 position at 54,794 contracts.

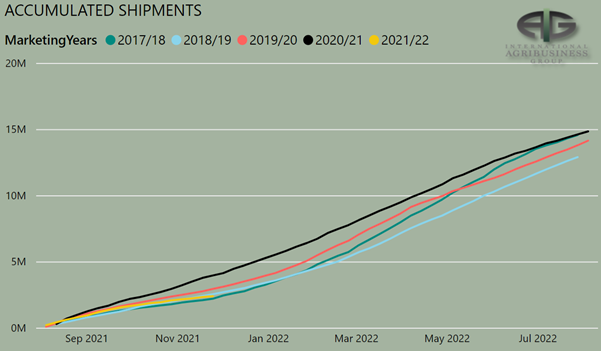

– This week’s USDA export sales report for the week ending 25th November was surprisingly large with total net sales of 374,900 bales reported. The largest two buyers were Vietnam with 147,100 bales and China with 123,600 bales and this would suggest that the buying has been done by those large mills with operations in both countries, especially as the Vietnamese local market has been mainly focused on Brazil and WAF in recent weeks, not USA. The pace of shipments continues to be a concern with exports of only 71,400 bales reported for the week.

Conclusion

Cotton is experiencing a counter trend move downwards but in our opinion is nothing more than that! Unless the latest Covid variant stops the world in its tracks EAP think that this move lower will be eventually looked upon as a healthy correction in what is an ongoing bull market. Technically, we believe the market is at a key level, if support is found here we should look to recover some of the ground lost in the last few days with the first target Monday’s gap to 111.12. If we do not hold here we will likely see a test of the dollar level.

Nevertheless, we remain of the opinion that prices will stay in the 100’s for the rest of the season. EAP believes the eventual seasonal high will not be until the latter part of the 1st quarter of 2022, probably in the high 120’s based on what we know today.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.