- Jo Earlam

- June 27, 2022

- 1:46 pm

- 10 min read

Cotton high of the year already in and much lower prices are forecast ahead!

If you don’t know what port you're sailing to no wind is favourable!

CTN22 – 103.76 (-32.56)

CTZ22 – 98.05 (-3.96)

CTH23 – 93.52 (-4.21)

CTK23 – 91.13 (-4.20)

CTN23 – 88.84 (-4.17)

Zhengzhou CF209 – 18,275 (-240)

Cotlook “A” Forward Index – 118.95 (-6.00)

Daily volume – 43,493

AWP – 140.47

Open interest – 175,238

Certificated stock – 10,606

July/Dec spread – (+5.71)

Dec/Mch spread – (+4.53)

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The last week proved to be one where records were made and not a time to be involved in N22. With no price limits on 1st notice day, N22 collapsed by 32.56c/lb in a day, for the largest fall since modern day records began, even eclipsing the 2011 1st notice day fall of 19.20 c/lb.

– If there was ever a reason NOT to leave one’s fixations to the last minute then this was surely it! We remind readers of our comments of the weekend report dated 4th June, when we said… “Don’t be involved in July futures into expiry if it can possibly be helped”

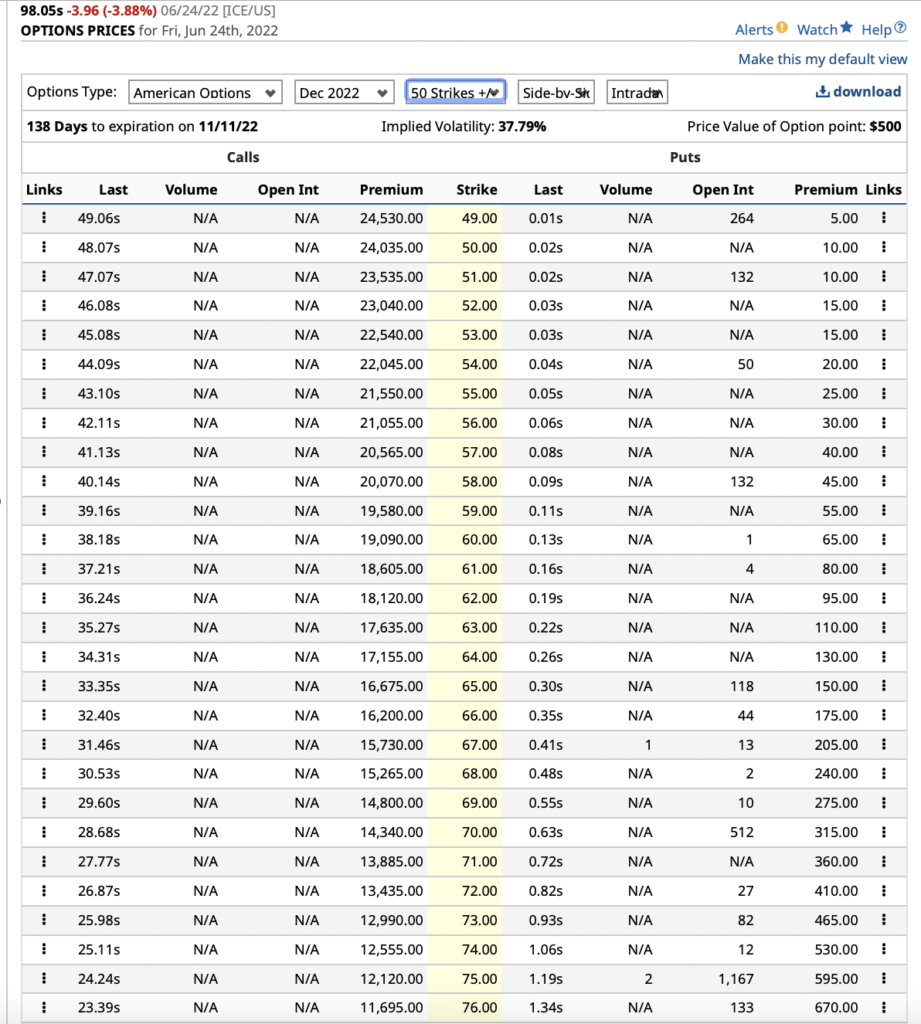

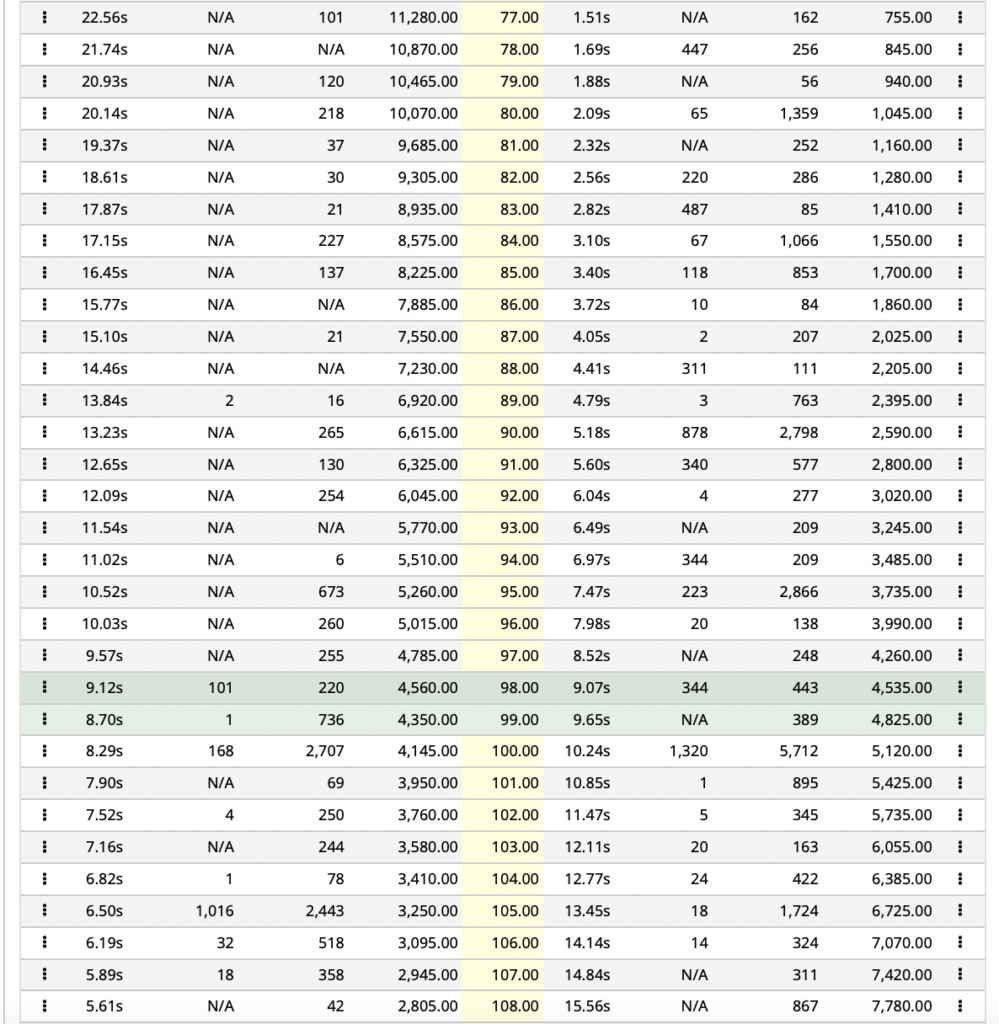

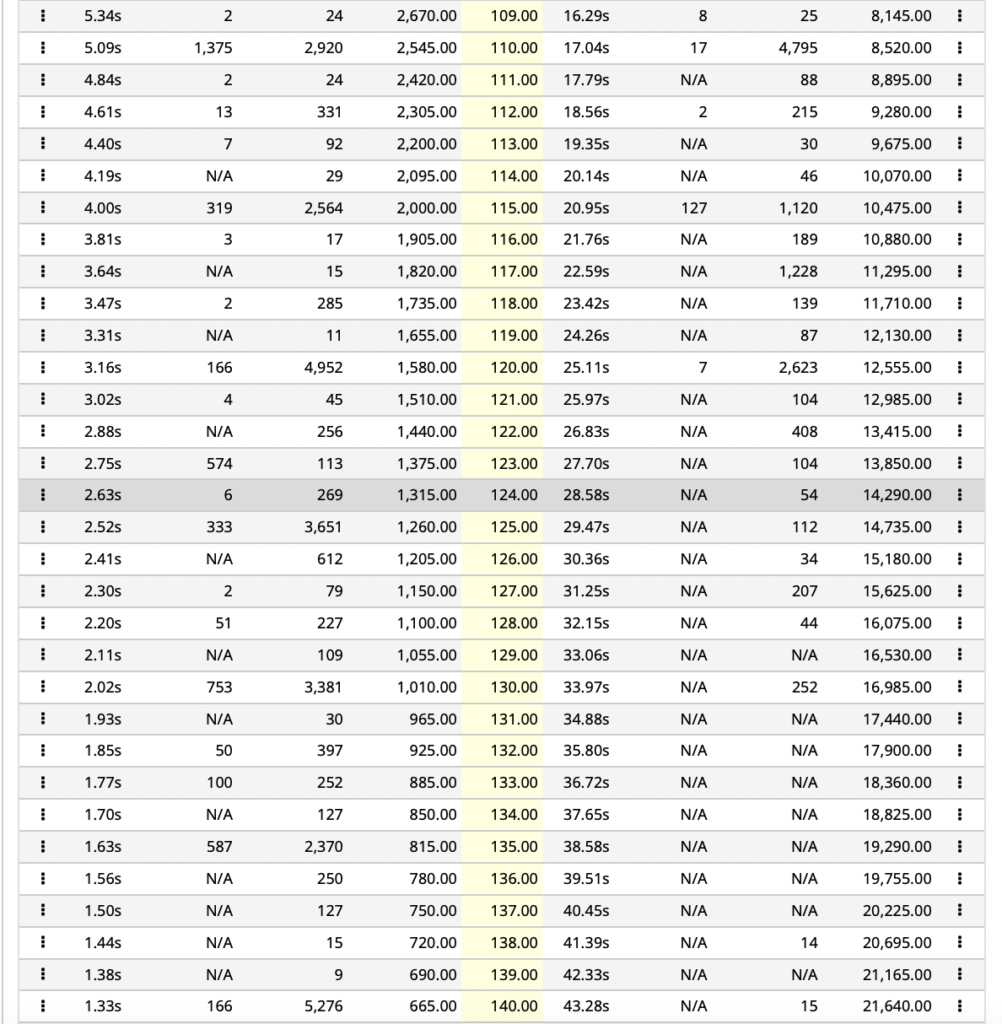

– Z22 traded the week in a huge range of 2654 points between 97.33 and 123.87 before closing the week 2024 points lower than the previous Friday close. Volume was high, averaging 51,502 futures daily over the 4 trading days of the week. Options volume was equally impressive with 18,295 trading daily with calls slightly more actively traded. Implied at the money volatility (i.e. how expensive) in Z22 remains historically high at nearly 38% and interestingly there is only a much reduced skew to calls than a week or so ago! It makes one wonder whether some are waking up to the fact that this market still has significant downside risk!!

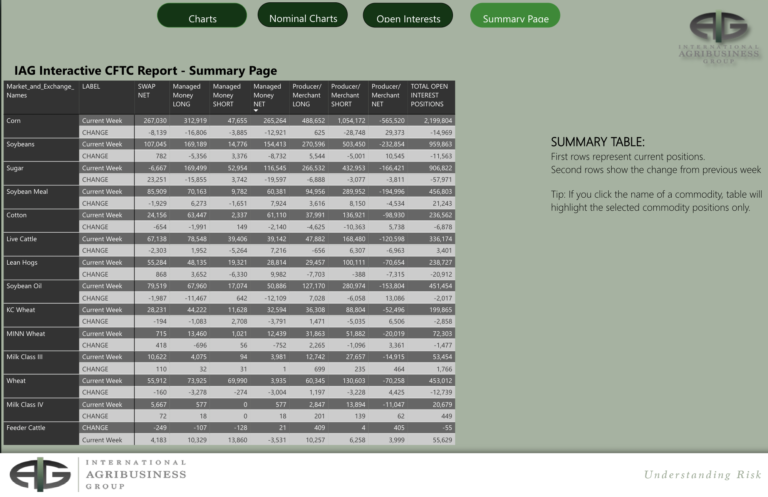

– The CFTC COT report showing traders positions as of last Tuesday, saw Managed Money (MM) as sellers of a net 2,140, taking their net long to 61,110 contracts. Other Reportables (OR) bought a net 395 and Non Reportables (NR) sold a net 3,139 contracts. MM, OR and NR now hold a net long of 74,773 contracts or just under 7.5m bales. Noting our guesstimate a week ago that this position was held at approximately 117.50c/lb, they are approximately 20c/lb under water on this position based on Friday’s close. Hedge funds do not hold losing positions of that magnitude…they will simply be forced to GET OUT!

– On Tuesday, the overall open interest in Cotton was 191,161 and by Friday’s close it was 175,238. This was a further reduction of just under 16k contracts in 3 business days, meaning we can probably assume they have sold at least that number of contracts since that report. The problem is MM, OR and NR are still very long of probably 6.0m bales or 60k contracts. They will likely be forced sellers meaning any potential “DEAD CAT BOUNCES” (which we may see at some point next week) are likely to be met with persistent fund selling. On the other side of the equation are the physically uncovered end users who may be thinking how fortunate they are to be able to buy a market 35c/lb lower than they could have done less than 6 weeks ago. However,it will depend on whether the yarn price hold up and whether our end user holds off from buying. It would be quite normal for them to wait to see a bounce before committing to the long side of the market. In the meantime it could just keep going down! Next week promises to be another volatile one!

– The below table courtesy of our friends at IAG, shows just how long MM funds are of Corn, Soybeans, Sugar and Cotton

– It was not just Cotton that got hammered last week but many other Commodities including the big brothers of Soy and Corn where funds were also heavily long and saw them both drop 10% in a week, against a 17% drop for Cotton.

– Equities are already in a bear market and it is now the turn of Commodities to take a beating. Money talks and “the Money” is selling hard and barring a miracle bounce, the momentum will likely railroad any bullish fundamentals that may be talked about (i.e. West Texas drought and physically uncovered mills).

– This promises to be an extremely painful time for those mills who were forced to fix at the July highs of last week and are made to open prompt L/C’s that for some will be literally 40c/lb above the market, in just under a week!

– This raises the stakes on probable defaults from the less strong mills and cries of “we cannot afford that loss!” Merchants thinking they are “well sold” may find they are actually a lot longer than they thought and potentially forced to hedge by selling Z22, whilst buyers find their banks are less than willing to open their L/C’s in the face of a collapsing market. The arbitrators at the ICA may find they are in for a busy Autumn sorting out the mess that looks increasingly likely to unfold.

– As always in times like these we look to technicals and statistics to try to determine what might happen next. Between 2012 until late September 2021 the market traded between 48.35 and 97.60 trying on no less than 5 occasions to break through that key overhead resistance lying in the mid 90’s. That area should now be strong support but the velocity of this current downward move may even see the market go straight through it and could even see a move to 88c/lb before any bounce occurs.

– The market held the 97 area in Friday’s trade and saw a much needed spike to 102.80 before the selling returned and closed right at the bottom of the weekly range.

– What is slightly more concerning is the severity of the fall which was even worse than in July 2011. On that occasion it took about 3 weeks to fall just under 50c/lb. This time we have fallen 25c/lb from the recent highs in just 4 days!

– We caution anyone about being long Z22 right now until we see some blue on the screen and a positive close! It is also the much anticipated USDA 30th June plantings report on Thursday!

Conclusion

Seen on he price action Friday has caused us to have to readdress our stance of seeing value at 98c/lb because the freight train cannot stop….read the money has to get out! EAP maintain our viewpoint this will be an inverse season and we have already seen the seasonal high at 133.79c/lb on the 17th May and it would not surprise us to see a move to the mid 70’s sometime in the late 1st quarter of 2023 before this bear market is over.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.