- Jo Earlam

- June 18, 2022

- 3:51 pm

- 10 min read

Oil gets walloped! Is the direction of Oil the key to where Commodities go next?

Is the supply chain crisis about to get worse from here and persist for years to come?

CTN22 – 143.45 (-0.08)

CTZ22 – 118.29 (-0.94)

CTH23 – 114.15 (-0.73)

CTK23 – 110.87 (-0.61)

CTN23 – 107.54 (-0.45)

Zhengzhou CF209 – 19,390 (-165)

Cotlook “A” Forward Index – 135.60 (+1.25)

Daily volume – 23,739

AWP – 140.47

Open interest – 197,929

Certificated stock – 1,087

July/Dec spread – (+25.16)

Dec/Mch spread – (+4.14)

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– As old crop N22 draws to a close, it has been another wild week with an average daily range of 300 points and N22 trading within a 500 point range between 142.50 and 147.50, before closing the week down 161 points. Open interest in N22 is down to just 18,551 contracts with just 3 business days to go until July 1st notice day. Overall open interest is now 197,929 and is the first time below 200,000 since mid August 2020.

– New crop Z22 paints a rather different picture trading in a 620 point range between 117.30 and 123.50 and finishing down 407 points from the previous Friday close. Volume has dropped off significantly following the end of the GSCI roll whilst puts and calls traded equally as traders question whether the spot price of Z22 can be justified in the face of limited physical demand!

– Volatility remains high with the average daily range for Z22 this month of 352 points.

– It is “Juneteenth” holiday in the USA on Monday, celebrating “Emancipation day” meaning there is a 4 day week next week with July 1st notice day on Friday.

– As we have previously documented, equities have had a bad week and the spill over may drift into commodities especially noting how hard Crude Oil was hit on Friday. The market touched the 50day moving average and whilst we believe we may see a small rally early next week it looks like a sell to us and could drag down the whole commodity complex as funds de-risk!

– The Fed announced another rise in interest rates on Wednesday, by 75 basis points, in their continued attempt to combat inflation, which is currently 8.6%. This was the biggest rise in interest rates since 1994. Interestingly, if we were to calculate todays inflation as it was calculated back in the 70s, the figure would be 13.5%, almost exactly what it was in 1979.

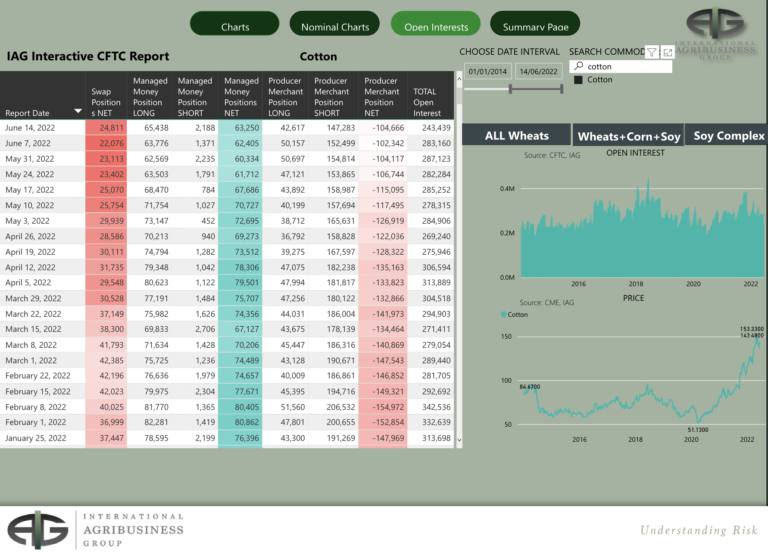

– The weekly CFTC COT report as of last Tuesday showed Managed Money (MM) to have bought a net 845 contracts. Frankly there were little changes elsewhere and their overall net long totals 79,857 contracts between MM, OR and NR. Looking closer, we can also guesstimate at what price their long is in Z22 based upon how Z22 has traded over the last month and during the roll period! We think that the average Z22 long held by MM is not too far away from the current price of Z22. A break of the recent low at 114.92 from the 2nd June would likely see a lot of these funds head for the exit!

– Levi Strauss updated their earnings guidance on Thursday, Their earnings per share guidance was $1.50 – $1.56, compared to the consensus earnings per share estimate of $1.55. Stifel Nicolaus lowered their price target on Levi Strauss & Co. from $30.00 to $26.00 earlier in the Month. All this week the price has been gapping down and whilst we may see a dead cat bounce in the days ahead we do not like the look of this chart! Judge for yourselves!

– On a technical point of view we do not like Cotton. We feel that stiff overhead resistance lies between 122.98 and 126.00 basis Z22. Below that we feel that the June 2nd low at 114.92 is likely to be tested and broken within the next days and weeks. Good support should be found between 103.84 and 110.69 where we might be persuaded to be a short term buyer in what we believe will be a rather volatile period!

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago. Any bounces in Z22 to 122c/lb up to 130c/lb were we to get them, should be sold in our humble opinion.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.