- Jo Earlam

- May 15, 2022

- 2:04 pm

- 10 min read

Macro factors will influence where Cotton goes to next!

For well over a century business cycles have run an unceasing round. They have persisted through vast economic and social changes; they have withstood countless experiments in industry, agriculture, banking, industrial relations, and public policy; they have confounded forecasters without number, belied repeated prophecies of a “new ear of prosperity” and outlived repeated forebodings of “chronic depression. – Arthur F. Burns

CTN22 – 145.20 – (-0.33)

CTZ22 – 127.99 (+0.32)

CTH23 – 122.82 (+0.47)

CTK23 – 117.21 (+0.51)

CTN23 – 111.51 (+0.47)

Zhengzhou CF209 – 21,290 (+30)

Cotlook “A” Index – 164.20 (+2.00)

Daily volume – 20,477

AWP – 140.82

Open interest – 202,762

Certificated stock – 1,100

July / Dec spread – (+17.21)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– It was a quieter week for Cotton with the front month July finishing the week up 159 points having traded in a 585 point range between 142.10 and 147.95 on average daily futures volume of 23,686. In options, calls traded nearly 3x more actively than puts with implied July volatility at a very high 38% and December at 35.8%.

– For December, it was a better performance than July with the new crop contract closing up 425 points at 127.99 having traded in a 612 point range between 122.53 and 128.65. Open interest in December continues to creep up daily and is less than 5/- contracts under old crop July, noting we have not even begun the roll period when funds roll from July into December, which is still 2 weeks away. One can realistically expect December open interest to be more than July by the end of next week and will be effective front month on account of being the futures month with the highest amount of bets in it!

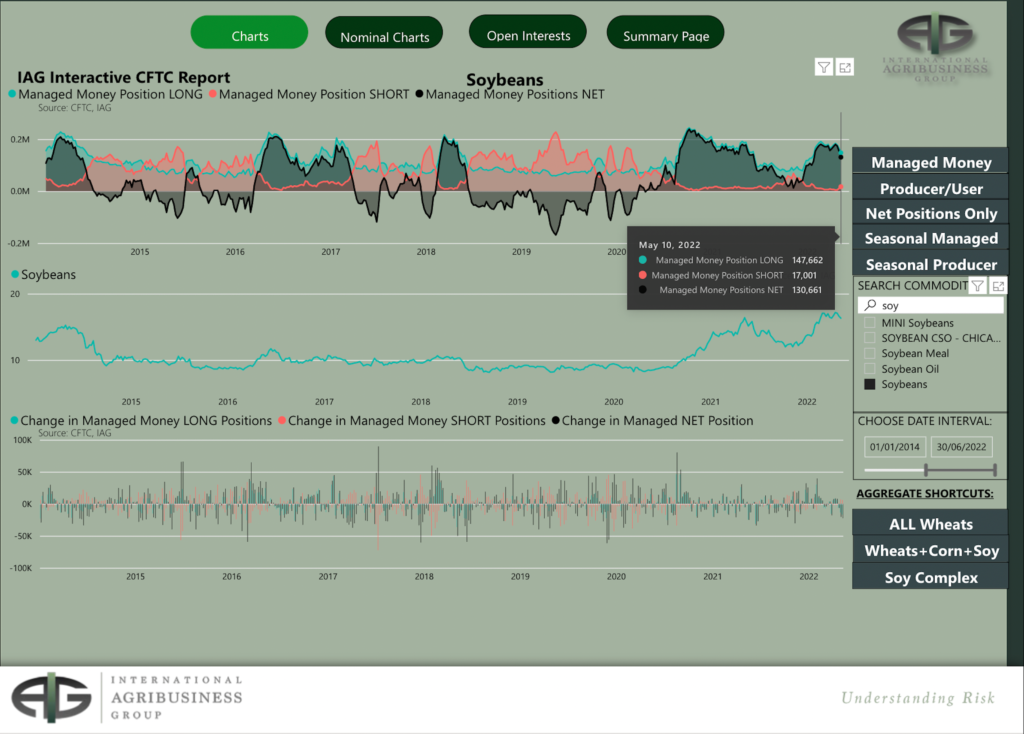

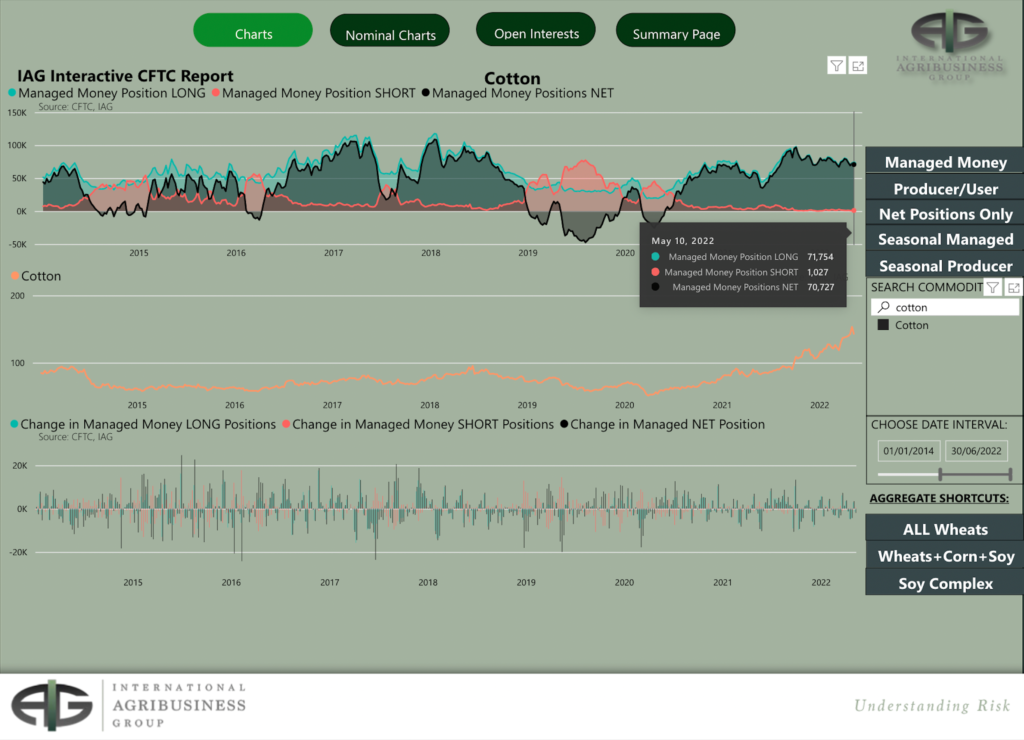

– The CFTC COT report after the close showed Managed Money (MM) to have returned to the sell side, albeit in a small way! MM sold a net 1,968 contracts to leave them net long 70,727 contracts. Other Reportables sold a net 1,814 and Non Reportables 1,455 contracts each. Between MM, OR and NR their net long position is down to 91,743 net long!

– Looking closer still we can see that the net long position is split with 40% in old crop July and the balance in new crop December!

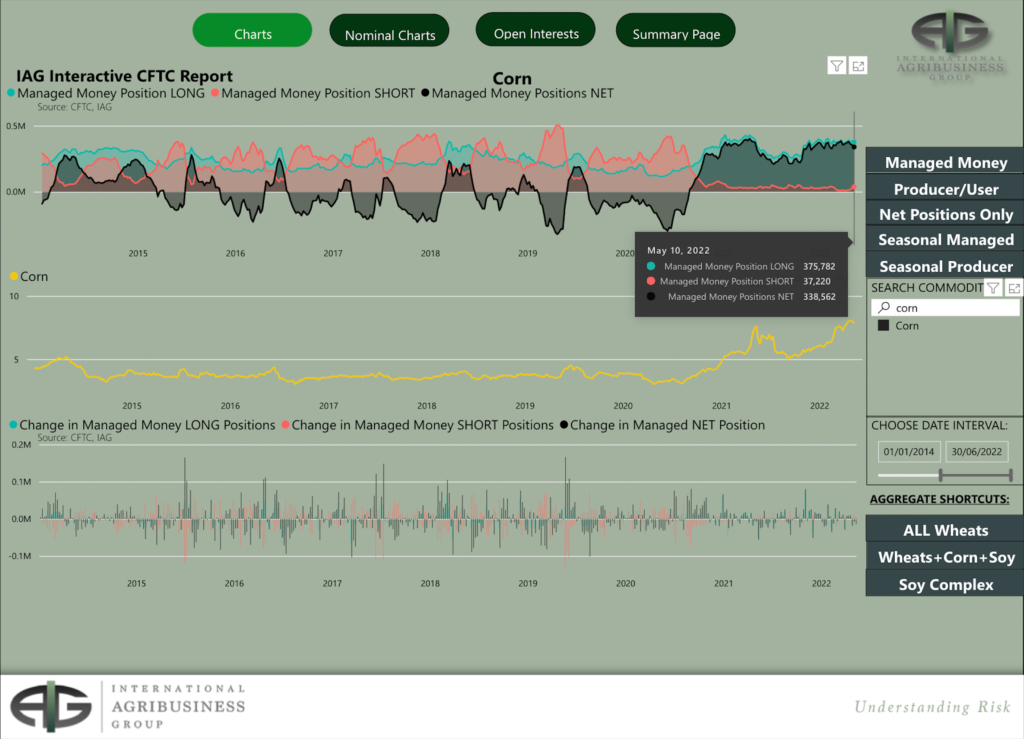

– The MM position in the big brothers of Soy and Corn remains heavily long and thanks to our friends at IAP for the pictorial evidence of the fact!

– This week we have seen the so-called stable coin, TerraUSD, tank and ripple through crypto currency markets. Stablecoins are supposed to match the value of the US Dollar, but its recent algorithm malfunction causing it to break its US dollar peg caused uncertainties about the crypto market. In a matter of 7 days, TerraUSD has dropped 84%, LUNA saw a decrease of 99% and Crypto-10 is down 25%.

– Economists such as Martin Armstrong, Paul Volcker and Arthur Burns all share the same view about the essence of a business cycle and the harsh reality that people who have tried to ignore and eliminate the business cycle and create the perfect world. Cryptocurrencies are an asset, not money. They are by no means a safe hedge against fiat currency and will never be, simply because nothing ever is.

– Often young people with expectations of living a new financial utopia with very aggressive punts in the crypto markets are lured in by beliefs that lines of codes and algorithms could reach the same importance of the Dollar, for example. Anyone who got in after Feb 2021 is now wondering if that was a good decision after all?

– The discretionary spending ability of many is being affected by what is happening in not only crypto currency but outside markets as well. None of this bodes well for the 2nd half of 2022.

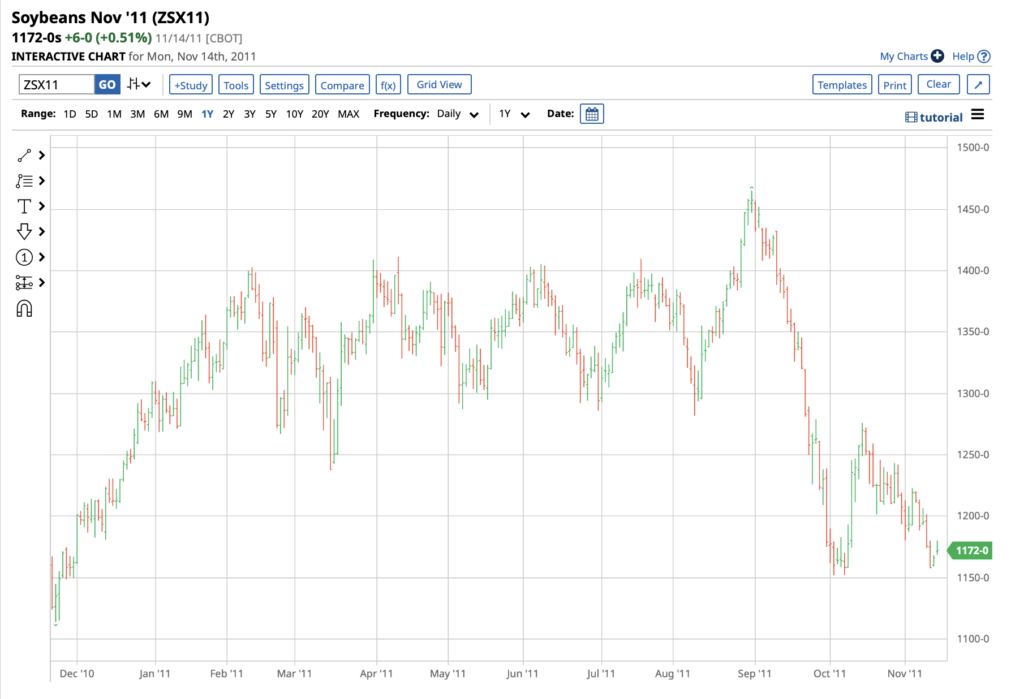

– Cotton has held up remarkably well as have the grains where funds remain stubbornly long of them all. We continue to bleat on about the similarities today and 2011 and will continue to do so because we think there is a reasonable chance it can repeat a similar pattern in the months ahead.

– In truth, back in 2011 the Z11 contract stayed relatively firm until the USDA plantings report published on the 30th June. After that and in the face of the worst Texas droughts in modern history and a lack of physical business, the price literally collapsed from a high of 123.00 on the 30th June to as low as 94.46 by the 18th July being a move down of 20-25% in a period of just 3 weeks!

– Soy and Corn on the other hand held up a bit longer than Cotton and were trading at very similar levels to where we are today. However they also eventually collapsed at the end of August 2011 and dropped 20-25% in under 5 weeks.

– Technically Cotton has so far not exceeded the July seasonal high of 155.95 seen the week before last. December on the other hand is still very close to its seasonal high of 129.91 and if Z22 is to make a new high we think it will be done this month or possibly next month latest!

– We maintain that macro concerns will eventually cause funds to exit a substantial part of their long positions and firmly believe that the 2nd half of 2022 will be a difficult time for the world!

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.