- Jo Earlam

- June 10, 2022

- 9:05 am

- 10 min read

Consumption under pressure from falling demand and MMF prices

The simple things are also the most extraordinary things, and only the wise can see them. – Paulo Coelho

CTN22 146.51 (+5.89)

CTZ22 124.93 (+2.39)

CTH22 120.11 (+2.37)

Zhengzhou CF209 – 20,400 (+95)

Cotlook “A” Index – 155.35 (-0.75) – 8th June

Daily volume – 40,670

AWP – 135.36

Open interest – 211,849

Certificated stock – 1,087

July / Dec spread – (+21.58)

Dec / March spread – (+4.82)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The front month Dec ’22 has enjoyed a strong week so far, closing today at 124.93 up 239 points on the day and 464 points above Friday’s close. Some of this strength may be attributed to disappointment in last week’s Texas rains, or perhaps to yesterday’s news out of India (below). However, more likely, in a very quiet week, it is has simply been pulled higher by the chronological front month July ’22 which is in a period of extreme volatility with options expiring tomorrow, the Goldman Roll on going and a large unfixed mill position still to be addressed.

– As noted in previous reports the July on call position has dropped a place to the second highest ever for this point of the season, behind the 17/18 season at which point the net N18 position stood at 31,769 contracts compared to 26,698 contracts in N22 today. Below are the charts of N17 (left) compared to N22 to date (right).

– India yesterday announced an increase in the minimum support price for seed cotton from Rps. 5,726 per quintal to Rps. 6,080 per quintal, or an increase of 6%. Given cotton prices have been well above the MSP level all season long, this should have little material impact at current prices.

– Yarn pricing and consumption seems to be coming under incredible pressure in recent weeks. In India we are hearing reports of 20% cuts in production from recent levels, whilst we are also hearing of some switching to MMF. In Pakistan much switching to MMF is also taking place, along with reductions in consumption as yarn stocks build. In the Far East we hear reports of retailers delaying orders, whilst polyester is offered not far above 60 usc/lb.

– China continues to offer cotton ex-consignment port to alternative destinations. Meanwhile, we hear of Chinese mills offering to resell existing contracts for Aug / Sep shipment to overseas buyers. Whilst the headlines have focused upon easing of lockdowns in Shanghai, and the direction of travel is certainly positive, there remain approximately 74 million people in China still under full or partial lockdown according to research from Japanese bank Nomura.

– Heavy rains in New South Wales, Australia has led to two-month delays for harvest as pickers are unable to get into the fields. The heavy rain has caused substantial degradations on colour and quality in major growing areas. For the 2022 crop, we are expecting a significant increase in discounted 41Cg and four leaf as a result. Overall production estimates range from 5.3 – 5.5 million bales.

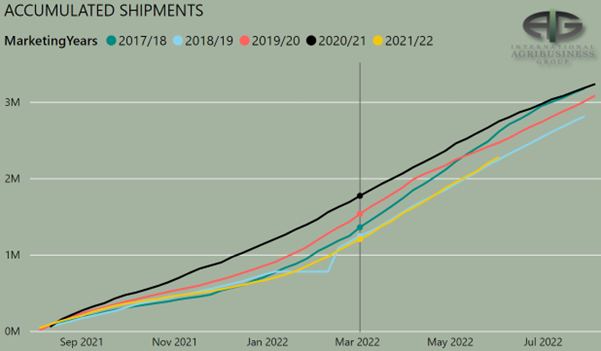

– Here we go again, in a week where China continued to offer cotton ex-consignment stocks to Vietnam and Vietnam continued to not buy it, US export sales for 2021/22 crop totalled 259,200 bales with China accounting for 114,500 bales and Vietnam for 104,600 bales. Furthermore, given the report was for the week ending 2nd June, standard merchant terms would require an L/C to be opened by 15th June and a merchant would not issue load out instructions to a warehouse until the L/C was in hand and operable. This best case scenario would leave 45 days for the warehouse to book the cotton out (at a time when they should be inundated given the imbalance between reported sales and reported shipments for the year to date) and get the cotton on a boat before the 2021/22 marketing year ends. This would suggest that, even if these “sales” were actually made in the week ending 2nd June, contracting and reporting 259,200 bales for shipment in the 2021/22 crop year is at best delusional.

– Shipments were reported at 335,900 bales and, with 8 weeks remaining of the season, we remain well off the pace required to meet the USDA target of 14.75 million bales of exports. It would seem logical that this number is cut in tomorrow’s WASDE with 2022/23 exports increased accordingly.

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago. Any bounces in Z22 to 122c/lb up to 130c/lb were we to get them, should be sold in our humble opinion.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.