CTZ21 92.33 (-0.18)

CTH22 91.59 (-0.21)

CTK22 91.24 (-0.19)

CTN22 89.63 (-0.14)

Zhengzhou CF201 – 17,440 (-105)

Cotlook “A” Index – 102.30 (-0.75)

Daily volume – 19,669

AWP – 79.53

Open interest – 272,662

Certificated stock – 63,515

Dec/March spread – (+0.74)

December Options Expiry – 12th November 2021

December 1st Notice Day – 23rd November 2021

Introduction

– Going into today there was a fair bit of (blind) optimism around the market that the top of the recent 89.92 / 77.50 front month range could be breached. In reality, despite encouraging export sales and US GDP numbers, and an initially positive reaction for the front month March ’22 contract, this proved a forlorn hope.

– We should not discount that an improving demand outlook may yet necessitate a reappraisal of this range, but for now, as can be seen on the chart below, the top end of the rage has been well defended.

– Bangladesh hosted the Global Cotton Summit with delegates from the local industry and around the world. The consensus is that mills in the country are currently running at around 60% of capacity. In addition to sluggish demand, gas supply is proving unreliable and the government have hiked gas prices by 179% to come in to effect in February!!

– Pakistan’s growing economic crisis came to a head today as exchange rate controls were lifted in accordance with IMF bailout conditions. In response, the Pakistani Rupee tumbled (below), finishing the day almost 10% lower.

– Prior to implementation of any agreement with the IMF, the Central Bank is reported to have reserves below USD 5 billion, which is less than the value of one month of imports. This will be more than evident to anyone who has been waiting for a letter of credit to be opened from Pakistan recently. A merchant’s eyes can often view a mill’s protestations that these matters are beyond their control with a good deal of scepticism. However, this is perhaps one of the times when the reality of the situation goes much deeper and should be considered.

– We may not be merchants at EAP, but we once were. In times like this the short term reaction is often to take a hard line with a mill who is struggling to perform. In our experience (and hindsight is a wonderful thing), this is rarely the route to a successful outcome. On the other hand, merchants that are prepared to address the problems rationally with mills will find that not only are the contracted commitments performed over time, but also that their client relationships are deepened to both sides’ long term benefit.

– The situation is causing severe issues on the mill production. With a much-reduced local crop Pakistani mills are reliant on imported supply to keep their spindles moving, even at current reduced capacity. Reports are that there is only cotton on hand for around 60 days’ worth of consumption without an uptick in the flow of imports. Mills are already reducing consumption further in anticipation of a shortage of stocks and this is only likely to get worse the longer the situation lasts.

– In reaction to the Fed’s aggressive monetary tightening US GDP growth slowed in Q4 to 2.9%, compared to 3.2% in Q3. Nevertheless, given the Fed’s actions this was still viewed as a resilient number and was above consensus predictions of a 2.6% increase.

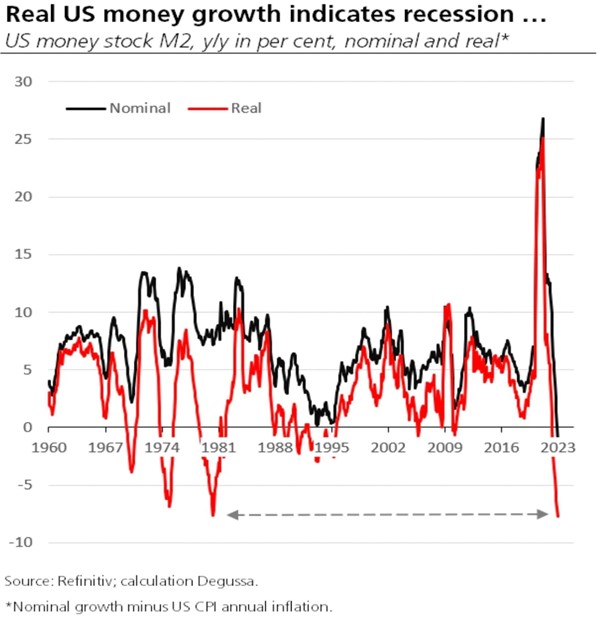

– The drop in real U.S. Money Stock (M2) is at its most severe level since 1980 (chart below), which proved to be the talisman an early recession. The M2 is the U.S. Federal Reserve’s estimate of the total money supply, including cash in hand, money in checking and saving accounts and other short-term saving vehicles. In addition, Americans are racking up credit-card debt as interest rates continue to rise at a time when the upcoming tax season fast approaches.

– The USDA export sales report based the week ending 19th January showed another week of robust sales, though perhaps not the blockbuster number that some were predicting. Net sales for current crop totalled 213,700 bales, China was once again the strongest buyer with 59,200 bales, followed by a resurgent Turkey with 55,200 bales and Vietnam with 42,400 bales (once again we believe this is largely attributable to China owned entities). Net sales for new crop were a disappointing 6,100 bales to Honduras, which actually reflected a cancellation in current crop and would indicate a rolled contract rather than an outright cancellaion. After months of lagging sales, this is now the second week in a run that sales have exceeded the weekly average needed to reach the USDA target.

– The CFTC cotton on call report, based positions on 20th once again provoked little comment. The overall current crop on-call sales position fell by only 229 contracts. Within this, H22 positions fell 1,562 contracts, whilst K22 rose 915 contracts suggesting some small-scale rolling. In summary, “very little to see here.”

– Inditex, the owner of Zara and a number of other brands, continues its strong performance and is now valued at levels not seen for a year.

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the high 80’s as fully valued and, for now, see any move for this contract into the low 90’s as a selling opportunity. The market remains plagued by a lack of demand though pockets of improvement are to be found in certain parts of the world. A tightening of supply, notably in India, prompts us to raise our downside ideas to the mid to high 70s.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.