- Ben Williams

- December 17, 2022

- 11:05 am

- 10 min read

Strong week for US export sales!

Indices

Futures

Forex

– This week we saw the March contract take over as the effective front month on account of it having the highest open interest. It closed the week 83,980 contracts higher than the January contract.

– There are growing fears that wee are going to see serious over supply late into 2023 with a record Brazilian crop and a poor demand outlook. Many commodity consultancies and government owned institutions suggesting we will see a 150 million tonne crop for the 2022/23 marketing year and acreage at 107 million acres (4.2% increase YoY). This, along with an estimated 118.3 million tonnes from the US crop, will account for around 70% of the worlds production.

– Brazil domestically consume around 45/50 million tonnes so this will leave 100 million tonnes of soybeans for export which the world doesn’t need. The common destination would be China who are the worlds biggest soybean consumer and are forecast to import 98 million tonnes this year. However, unless their zero covid policy has come to and end during the first half of next year their consumption is going to be down from normal figures. And even if things do open up, it will take time for consumption to get back to where it was.

– It is looking unlikely that Argentina’s ‘soy dollar’ will have the same success that it did the first time round. The scheme was reintroduced in late November to boost exports and foreign currency reserves but only 2.98 million tonnes have been traded as part of the scheme since November 28th. This is nearly three times less than the same period in September which was 8.48 million tonnes.

– This is largely down to the fact that Argentinian farmers have been holding onto soybeans stocks as a hedge against the rapidly falling peso. They also sold such large volumes the first time round that inventories are low meaning they are more hesitant to sell.

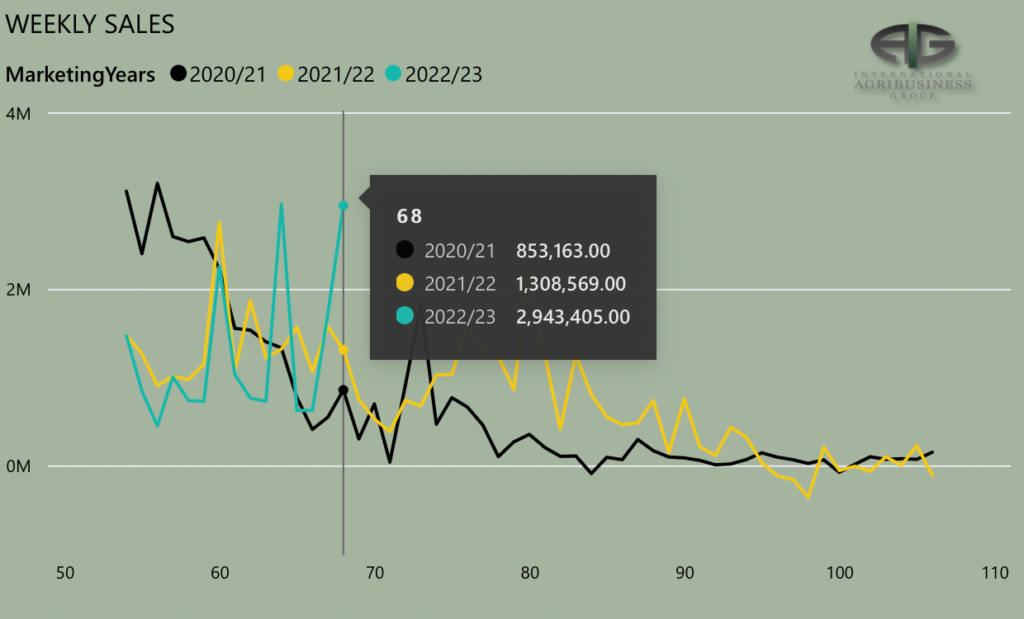

– Another factor is the fact that China have opted for other origins and this could be seen in this weeks US sales report. The fact that Argentinian beans have a lower protein content makes them less appealing to crushers who have to blend them with other beans too get the desired protein levels from their crush. US export sales were the second highest so for for 22/23 at nearly 3 million tonnes, of which 1.27 million tonnes were Chinese sales.

– The CFTC commitment of traders report from 13.12.22 showed that Managed Money added to their long positions by 13,966 and reduced their short positions by 6,160. They are now net long 119,580.

– OR reduced both their long and short positions and are net short 2,421. NR added to their long and short positions, they are net short 33,310 contracts

– The January contract traded fairly sideways this week in a 29.6 cent range and only closed the week down 4.4 cents. It looked to have found support from the 61.8% retrace level on Monday/Tuesday and there looks to be some overhead resistance between the 1492-1498 levels which we have seen this market fail at multiple times over the last 6 months.

– Elliot Wave still see near term strength with prices going as high as 1530 basis the March contract, in Q1 of 2023. However, they are expecting it to be short-lived and still see prices going to the 1170 level in mid 2023.

Conclusion

The market may continue to trend in this upward trend channel but we expect it to encounter overhead resistance fairly soon which we think will be followed by a downward move. With Brazil still looking set for a record crop we are bearish this market.

Written by:

Ben Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.