CTH23 82.17 (+3.53)

CTK23 82.00 (+3.15)

CTN23 81.16 (+2.44)

CTZ23 77.26 (+1.38)

Zhengzhou WQF23 – 12,935 (+45)

Cotlook “A” Index – 92.20 (+3.00) – 2nd November

Daily volume – 75,109

AWP – 68.95

Open interest – 251,742

Certificated stock – 880

Z22 / H23 spread – (+0.83)

Z22 / Z23 spread – (+5.74)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Following weeks of bearish price action, the market has certainly rebounded so far this week with three days out of four seeing limit up moves – including the options market being locked limit synthetically on Tuesday. The market closed today at 83.00 basis the Dec ’22, 1089 points over Friday’s close. If this is a dead cat bounce then it would appear to be a lion!!

– Having said that, by Friday the market was in oversold status and the specs were most likely flat. Therefore, there has been a dearth of market actors needing or wanting to sell this rally, giving it a resistance free ride to the upside.

– One explanation for the positive start to the week across all markets was the stories that China may soon move to roll back the zero covid policies which have acted as such a drag on the country’s economic performance (not to mention people’s lives!). This hope seems to have been inspired by the approval of an inhalable vaccine which would hopefully increase take up rates amongst the population. To put this in context however, at the time of this soaring optimism, Foxconn’s Zhengzhou factory was being placed into full lockdown and authorities in Shanghai were pursuing thousands of people for testing and potential quarantine, after one guest at Shanghai Disneyland reported positive. Even if we are to see a, welcome, move away from this policy, normality is only likely to be at the end of a long road.

– In India the new crop is beginning to move and we are seeing some signs of positivity in the market. Farmers are asking for Rs. 10,000/quintal, whilst the gins are at Rs. 8,000/quintal. Because of this disparity, farmers are holding back to a degree and the pace of arrivals is behind last season, but cotton is moving and ginning is underway.

– At these levels, the break even for gins is around Rs. 65,000/candy, mills are below these levels and a little business is being transacted between Rs. 64,000 and Rs. 64,500/candy. However, the bulk of the business recently has being taken by international merchants who have been pricing their offers basis ICE and selling in the low 60,000’s.

– At these levels the fine count mills are breaking even to a small positive margin and the outlook for consumption is positive. Coarse count mills remain under water at these levels and still need to see some improvement.

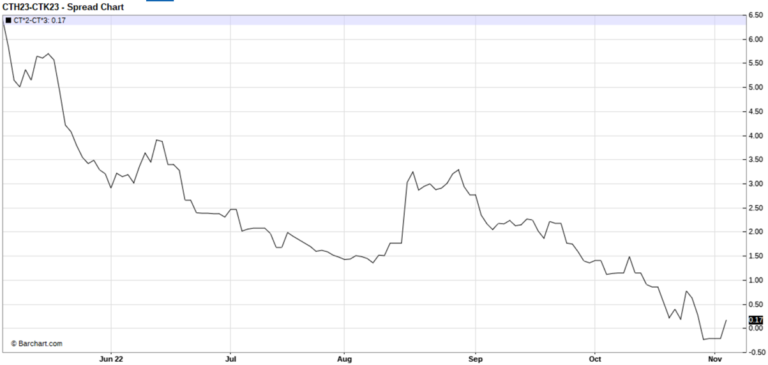

– Whilst much focus has, understandably, been on the Z/H spread the H/K spread briefly returned to a small carry in recent days.

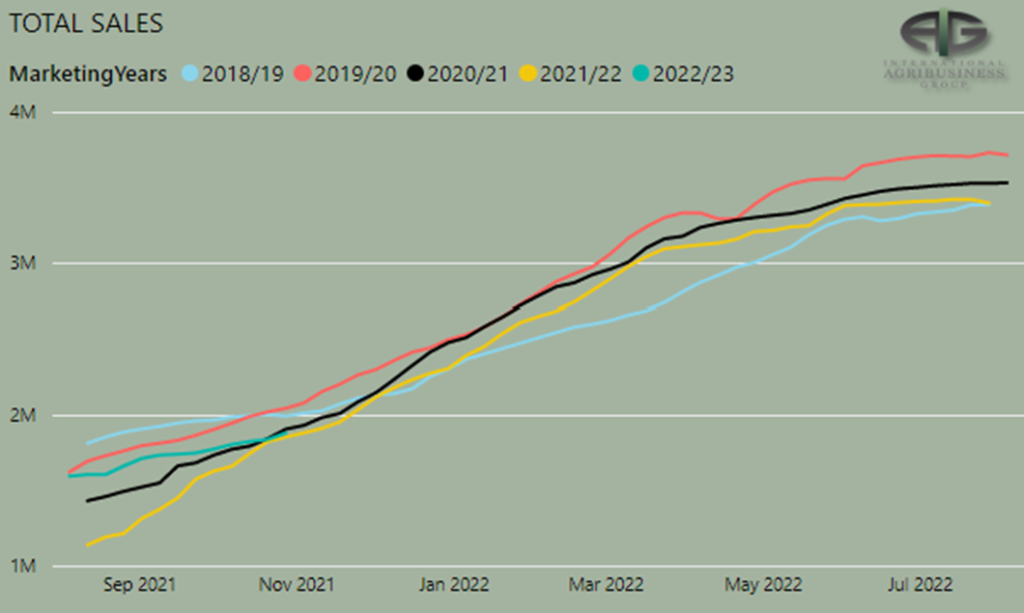

– The USDA export sales report for the week ending 27th October finally saw a new #1 buyer, ending Pakistan’s long run at the top. China bought 122,000 bales out of a net total of 191,800 bales for current crop with many reports putting this as related to the expiry of quotas rather than significant consumptive demand. New crop sales were markedly low at 11,200 bales. Shipments totalled 119,000 bales for the week.

– The CFTC cotton on call report, based positions for the week ending 28th October showed further reductions in the net on call sales positions. As with last week, the major reductions seemed to come from outright fixations in the Dec, rather than rolls to the March. Net on call sales were reduced 4,004 contracts, with 2,216 contracts of this reduction in the Dec. The March position was essentially unchanged, whilst, interestingly, July was reduced 1,075 contracts.

Conclusion

The cotton market has found support at the long term 70c level suggested in the weekend report and recent spec shorts have almost certainly being forced to readdress their standpoint. Fundamentally the market looks more than fully valued to us in the low 80s and judging by how often our phones and others have been ringing for physical cotton this week in the face of 3 limit up moves we strongly suspect that it should not be a surprise to see the market capitulate to the downside as we approach Z22 expiry a week from tomorrow!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.