- Jo Earlam

- October 30, 2022

- 11:03 pm

- 10 min read

December Cotton has fallen over 60c in just over 5 months!

If we become increasingly humble about how little we know, we may be more eager to search!

CTZ22 72.11 (-3.00)

CTH23 72.07 (-2.74)

CTK23 72.30 (-2.23)

CTN23 72.36 (-1.42)

CTZ23 71.16 (-0.47)

Zhengzhou WQF23 – 12,615 (-275)

Cotlook “A” Index – 92.50 (-2.75)

Daily volume – 40,983

AWP – 68.95

Open interest – 248,285

Certificated stock – 880

Z22/H23 spread – (+0.04)

Z22/Z23 spread – (+0.95)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– CTZ22 continued its vicious move to the downside smashing through previous areas of support to close the week down 10% in a week and limit down at 72.11. Volume was similar to previous weeks at 36,070 futures daily whilst in options, call activity was almost 50% higher than puts!

– The big question for so many right now is when is the pain going to stop and to that end we have included a cotton continuation chart below showing prices from 1970 to the present day. Fibonacci levels are identified for this century alone which show the lowest and highest price prints of 28.20 and 227.00 and identifies the 70c/lb level as a major area of support!

– Catching the falling knife is not a recommended pastime and prices almost always overshoot to the downside and we expect this time to be no different. However, at some point you have to be ready to change the narrative and noting Cotton is very oversold right now the time is fast approaching to no longer be short, especially when looking at Cotton’s big brothers and comparing the future prices detailed below!

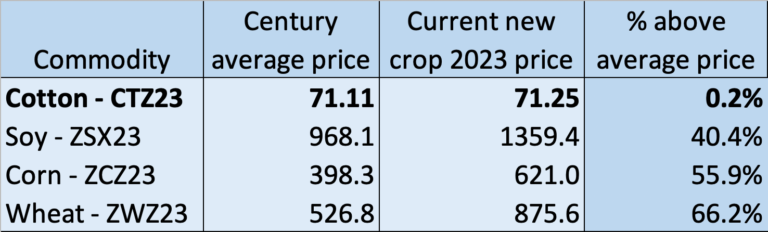

– Following on from last weekend’s comments, Z23 crop cotton is now cheap compared to its big brothers and now trading at this century average price. Back at the start of September we said “Cotton will revert back to its ‘mean’ and prices in the 100’s are seldom seen for extended periods” and that is where prices are now! Soy, Corn and Wheat on the other hand remain far above their century average prices and almost certainly justified on account of war concerns but much below their century highs of 1789, 849 and 1363 respectively. The difference between all of them will play a big part in farmers planting decisions come 2023.

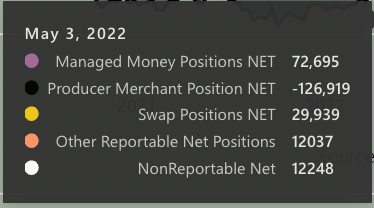

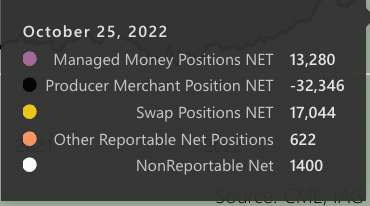

– We have long viewed that when “the money” makes its move whatever bullish fundamentals are bleated on about by pundits can often railroad any market. There can never have been a more relevant time than since early May when MM, OR and NR held a net long of 96,980 contracts against 15,302 today. A mammoth liquidation of 81,678 contracts or 8.17mb!

– Indeed, the CFTC COT report showed Managed Money to have sold for the 8th consecutive week having sold 8,752 contracts leaving them net long 13,280 contracts as of last Tuesday. Noting the collapse between then and the end of the week, MM, OR and NR are now probably flat but will not show up until next week’s report

– Our friends at IAG provide pictorial evidence of the fact for which we are most thankful!

Conclusion

– News from a spinning mill friend in Europe this week was encouraging to hear! Energy costs to operate their mill were 3x the cost of their 2021 average in August this year, causing operations to be massively curtailed, as seen in so many consuming market from Turkey to the Far East.

– However this month the costs have more than halved from this level and perhaps there is some hope for the beleaguered spinner!

– EAP expect Cotton to test the 68-70c/lb area next week, before any sort of meaningful bounce. Focus should centre on H23 in the days ahead as it becomes the front month on account of holding the highest open interest.

– In summary, end user “on call” fixations in the high to mid 60’s should be expected. Cotton rallies to the high 70’s or early 80’s are likely to be sold and EAP believe we will see a sideways market for the rest of the 22/23 season. We would not want to be short Cotton long term under 70c/lb!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.