- Jo Earlam

- October 23, 2022

- 8:03 pm

- 10 min read

Funds get out of Cotton!

The second best day of your life is when you buy your 1st boat! The best day of your life is when you sell it!

CTZ22 79.13 (+1.73)

CTH23 78.55 (+1.29)

CTK23 78.15 (+1.11)

CTN23 77.08 (+0.84)

CTZ23 74.57 (-0.15)

Zhengzhou WQF23 – 13,295 (+70)

Cotlook “A” Index – 95.80 (-4.00) – From the 20th October

Daily volume – 43,713

AWP – 76.76

Open interest – 239,398

Certificated stock – 880

Z22/H23 spread – (+0.58)

Z22/Z23 spread – (+4.56)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– In yet another volatile week for Cotton, prices traded in a wide range of 888 points before finishing the week down 402 points at 79.13 basis the Z22 contract. Volume picked up as the week progressed and averaged 37,272 futures daily.

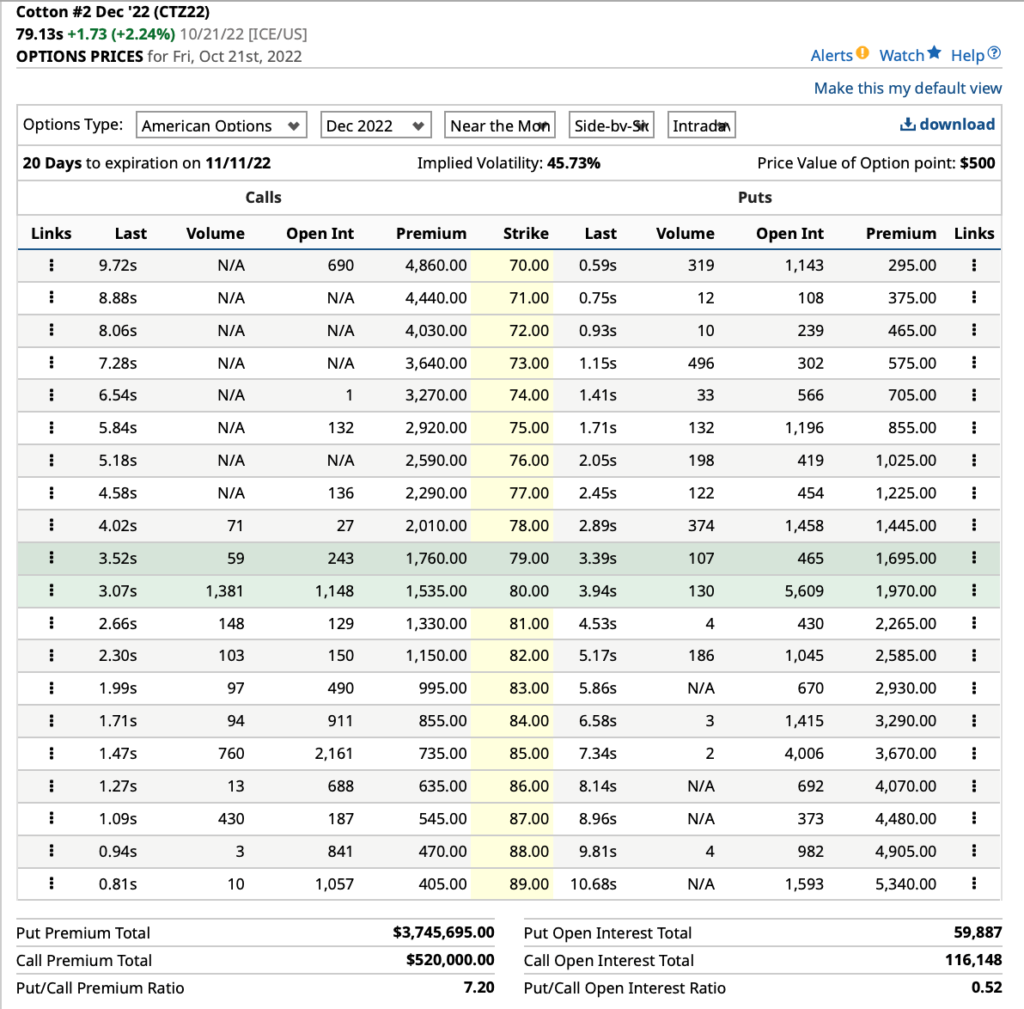

– In options, the November series expired on Friday and volatility remains high at 45.73% and reflective of the fact that last week prices in Z22 averaged a 314 point intraday range!

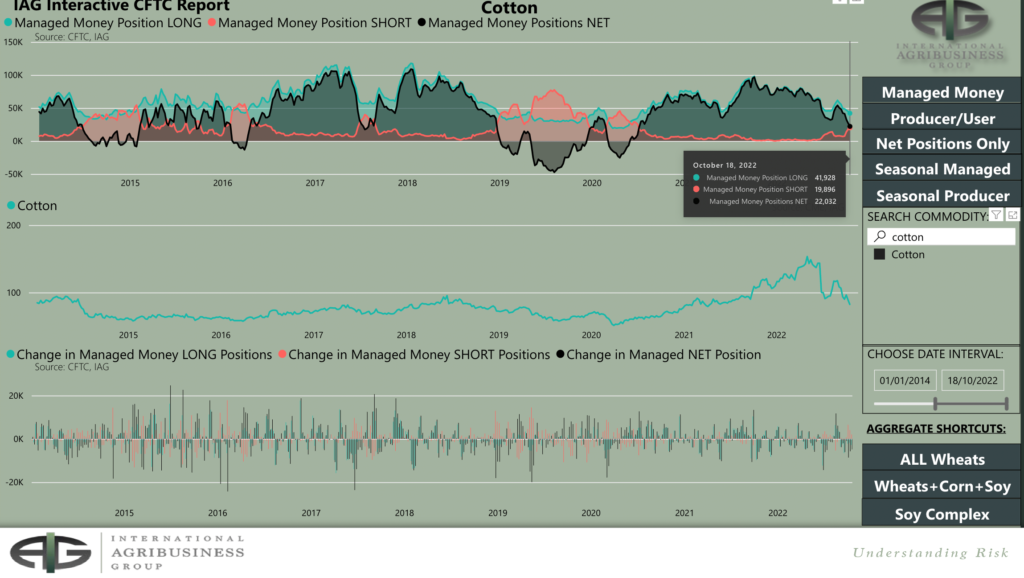

– The CFTC COT report showed that funds had once again been in liquidation mode with Managed Money (MM) selling a net 4,812 to take their overall net long to 22,032 contracts. This was the 7th week in a row that they have sold Cotton and makes for their smallest long dating back to July 2020 when prices were in the 60’s. Other and Non Reportables now hold a net position of short 293 and long 1,993 contracts respectively. Between MM, OR and NR their overall net long is now down to a paltry 23,732 net contracts long.

– Whilst MM could actually go short we suspect that their selling is probably done for now and why we are fairly sure that in the coming days and weeks the market will settle down a lot into the trading range we suggested in our Thursday report!

– Thanks to our friends at IAG for the pictorial evidence of the funds current position!

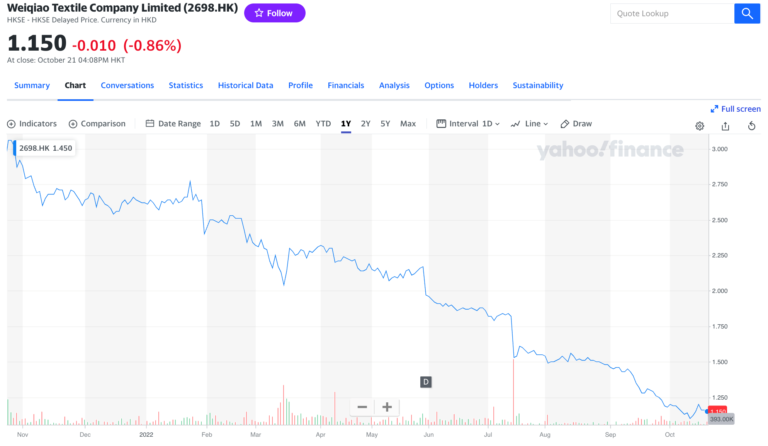

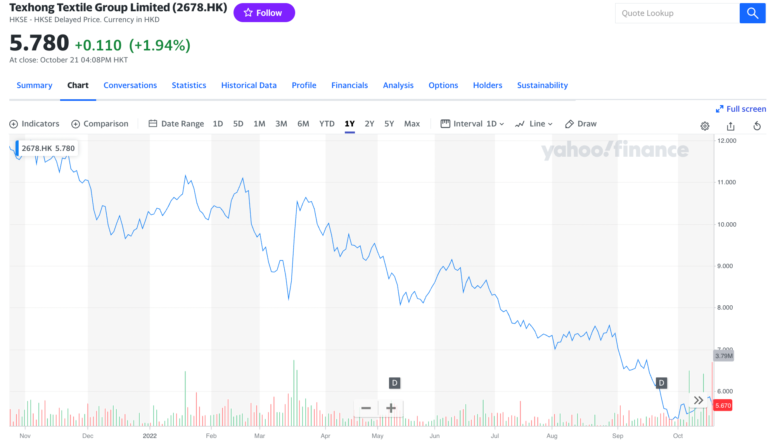

– Following the writer’s visit to India last week and the undoubtedly gloomy outlook from all within the spinning sector we thought it worth looking at two of our favourite charts of Weiqao and Texhong being two of the largest spinning mills of the world.

– Regrettably there is noting to suggest either of these companies are portraying a turnaround for the spinning industry just yet!

– Technically Cotton still looks like it has further downside and see no reason to try to catch a falling knife. I was taught by one of the very best in the industry that it is better to miss the 1st 5-10% of a move than to try to preempt it and get it wrong!

– The chart of December below would suggest that a test of at least 70c is inevitable at some point during the season. In addition we have still yet to see the capitulation selling that usually accompanies the end of a move resulting in a big spike lower and subsequent intraday reversal. Some might argue we had that in Friday’s trade but we do not think so!

– There has been so much talk in the market about how cheap Z23 is compared to the big brothers of Soy Corn and Wheat and how farmers will just not plant Cotton. Charts of all are included below.

– We cannot disagree, but those crops are 12 months away or more from harvest and the planting decisions for most countries in the world are months away and have yet to be made!

– Most farmers will, if they are able, choose anything but Cotton today. However that decision cannot and will not be made for a few months at least.

– To our mind Z23 is cheap, but see no reason to go long of it just yet unless one chose to go short of new crop Corn or Soy at the same time!

Conclusion

We expect Cotton to calm down in the days and weeks ahead and expect to see the market settle into a range of 73-86 basis the Z22 contract. Longer term we expect the weakness to continue into the new calendar year with a final low towards the end of the season probably under 70c/lb, meaning a sell the rallies approach is likely to be fruitful.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.