CTZ22 82.90 (-0.33)

CTH23 81.44 (-0.30)

CTK23 80.30 (-0.32)

CTN23 78.75 (-0.27)

CTZ23 74.81 (+0.10)

Zhengzhou CF301 – 13,515 (Holiday)

Cotlook “A” Index – 106.70 (+3.90) – 5th October

Daily volume – 29,615

AWP – 82.41

Open interest – 227,681

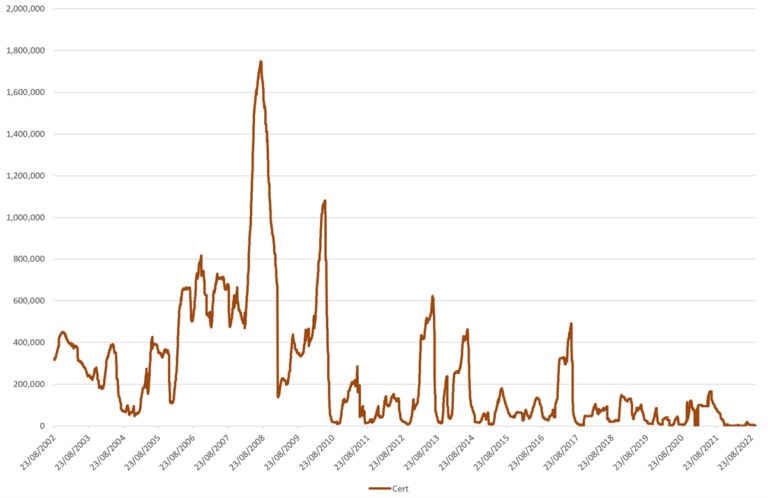

Certificated stock – 2,109

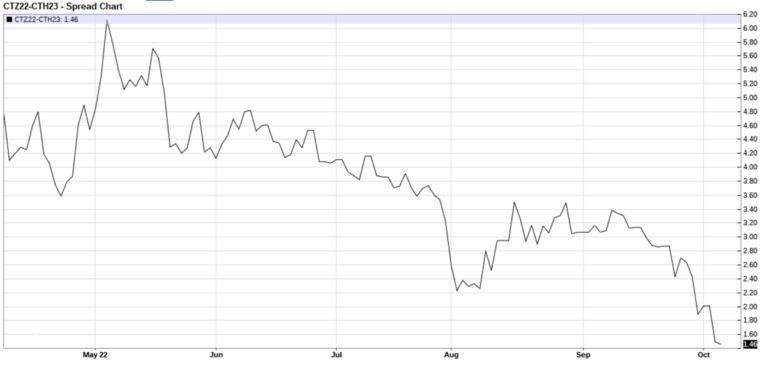

Z22 / H23 spread – (+1.46)

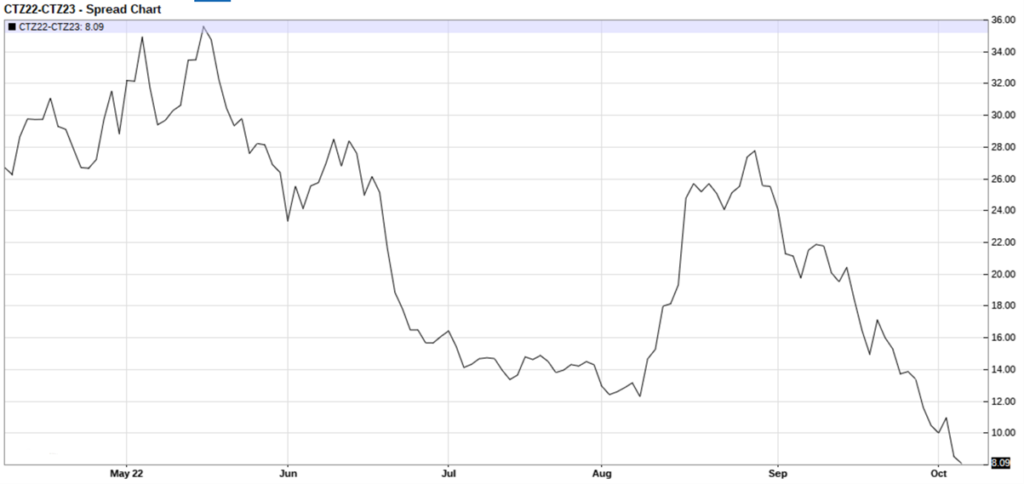

Z22 / Z23 spread – (+8.09)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– This week has been low on news but full of events, in four days trading we have had a limit up, a limit down and, today, new seasonal and life of contract lows. Yet, despite all of this action, it is hard to point to any triggering news events beyond the continuing moribund consumption outlook and the influence of outside markets, in particular the USD.

– As noted, cotton made new lows today basis the front month Dec ’22 at 82.10, taking out the previous low at 82.54 dating back to July 15th and putting in doubt what some technicians were speculating was a forming double bottom on the chart.

– As can be seen from the chart below, the Z22/H23 inverse has come in from a closing peak of 578 on 5th May and a more recent peak of 327 to today’s close of 146. This will no doubt come as a relief to the many mills with on call sales based the Dec but with shipment for forward months who will be looking to roll their unfixed commitments to H23, or even K23 and N23.

– One note of caution however, we are at historically low levels of certificated stock (second chart). With a decimated Texas crop and good sales commitments for the US crop overall, there is very limited opportunity for the creation of fresh cert in time for the Dec delivery period.

– This opens up the potential for a merchant squeeze as we approach Z22 expiry. Mills will be looking at the direction of travel and feeling confident as to their potential roll levels, but we would caution about waiting too long and recommend putting prudence first when it comes to rolling these positions. History tells us that when we see a merchant squeeze on one side and unfixed mills on the other, it doesn’t pay to bet on the mills coming out on top.

– Likewise, as can be seen from the below chart, the Z22/Z23 inverse has come in from a peak of 3476 on 17th May and a recent peak of 2777 on 29th August to close today at 809. With Dec ’23 undervalued relative to competing crops and the lack of demand being most closely felt in the nearby months we may well see this trend continue.

– The USDA export sales report dated the week ending 29th September showed an improvement over the previous two low weeks. Net sales for the 2022/23 crop year were 121,200 bales with Pakistan once again the main buyer with net purchases of 69,400 bales. New crop sales of 48,500 bales were primarily from, wait for it…… Pakistan (what a surprise), with 22,900 bales. Shipments for the week totalled 209,600 bales.

– Sales for the 2022/23 crop now total 8.5 million bales, which is 67% of the total USDA estimates of total exports of 12.6 million bales. Shipments total 2.1 million bales, or 16.5% of the total.

– CFTC cotton on call report, based positions for the week ending 30th September showed further mill fixations in the Dec ’22 where the net on call sales position we reduced 7,112 contracts to 23,422. Overall current crop positions were reduced 5,961 contracts with March ’23 increasing 1,271 contracts 14,021 contracts, suggesting that some mills have begun to roll. However, Dec is the second highest position for this week of the year, whilst March is the 11th highest, May is the 10th highest and July the 7th highest. This would suggest that further rolling will need to be done.

Conclusion

EAP believe that Cotton rallies into the late 80’s and early 90’s will be sold but Cotton in the low 80’s represents short term value. If we are wrong, then a move to 77c/lb can occur! A move back into the 100’s would be surprising, unless end user demand returns in earnest, which we seriously doubt! EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season. Scale up selling from 90c/lb or higher over the coming days (were we to see it) is likely to prove prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.