- Jo Earlam

- October 3, 2022

- 10:50 am

- 10 min read

End of the 3rd quarter of 2022 sees all Commodities lower!

It is the supreme art of the teacher to awaken joy in creative expression and knowledge.

CTZ22 – 85.34 – (+0.18)

CTH23 – 83.45 – (+0.72)

CTK23 – 82.09 – (+0.76)

CTN23 – 80.28 – (+0.88)

CTZ23 – 74.85 – (+1.29)

Zhengzhou WQF23 – 13,515- (+155)

Cotlook “A” Index – 107.10 – (+0.40) – From the 29th September

Daily volume – 41,377

AWP – 82.42

Open interest – 222,047

Certificated stock – 2,109

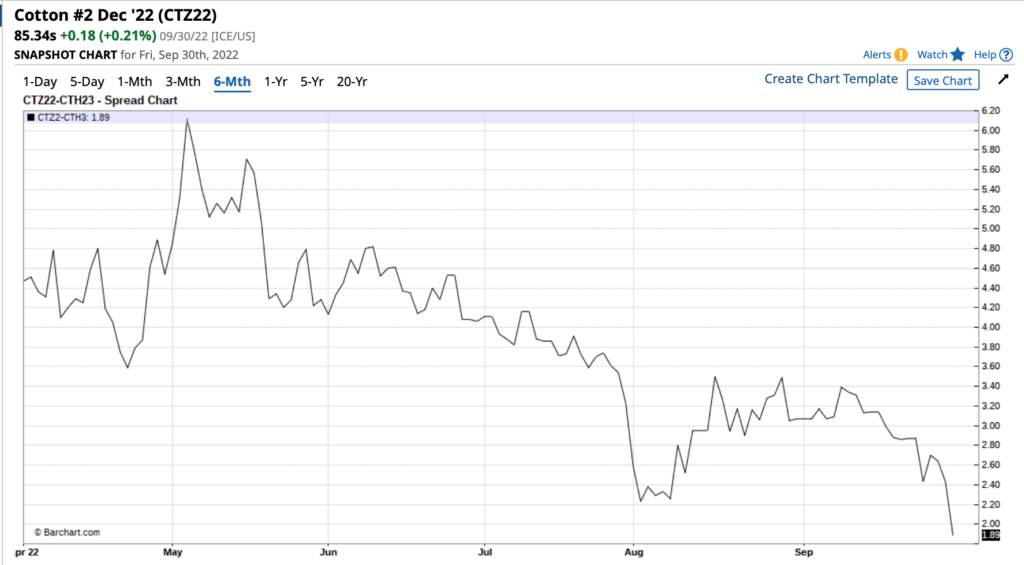

Z22/H23 spread – (+1.89)

Z22/Z23 spread – (+10.49)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– In yet another highly volatile week for the Cotton market, Z22 traded in a 1014 point range between 83.60 and 93.74, before closing at 85.34 and 720 points lower than the previous Friday.

– Futures volume was big, averaging 39,528 daily, whilst in options, trading was as big as we can remember, averaging 23,848 options daily, with calls once again outnumbering put activity by about 40%. The open interest can be looked at by clicking on the link below.

– Implied at the money volatility at 48.43% is very high and reflects the fact that last week’s daily range averaged 394 points. In the last 1 year, the average daily range has been 364 points versus the previous 5 year average of just 148 points! If prices calm down in the months ahead, expect “implied volatility” to drop to under 30%. In the 11/12 season, one had to wait until the 1st 1/4 of the calendar year for this to happen and is what we believe is going to occur in the months ahead!

– The CFTC COT report showed Managed Money (MM) have once again been sellers in the week ending last Tuesday. MM sold a net 910, whilst OR and NR each sold 1,188 and 3,595 contracts respectively. Between MM, OR and NR they now hold a net long of 39,957 contracts.

– Whilst this is a much reduced position, it is still quite long, but noting the volume of on call purchases by the end user that need to be fixed against Z22 mentioned in Thursday’s report (30,534 contracts), we believe at the low to mid 80’s Cotton will likely represent value!

– One should expect prices begin to calm down somewhat in the weeks ahead as the hurricane season draws to a close and traders can focus on the Cotton fundamentals rather than the macro picture. EAP estimate a more stable 80-92c/lb trading range into Z22 expiry!

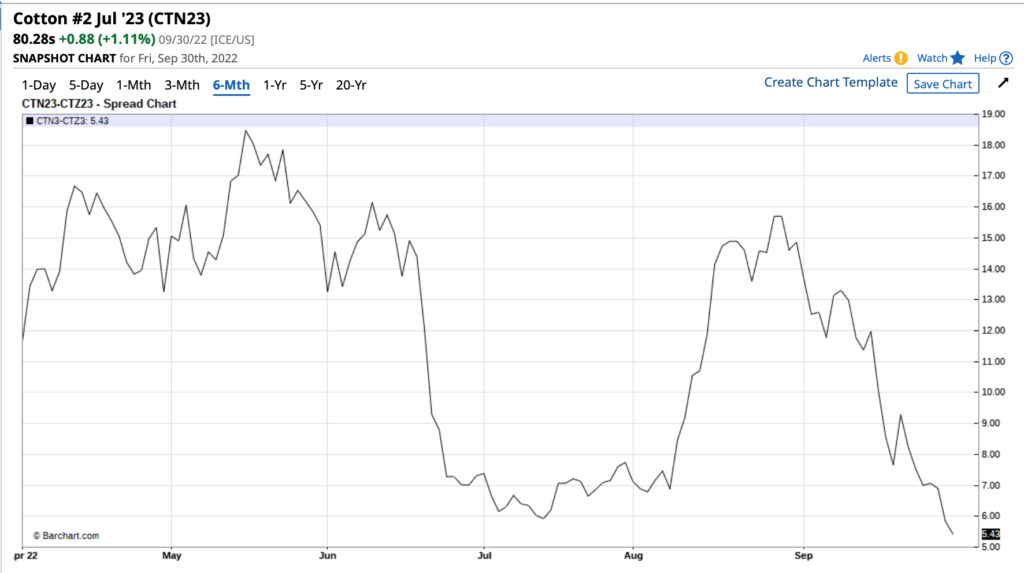

– The above chart is the spread between Z22 and H23 and between N23 and new crop Z23. What has been interesting over the last week is watching the spread between Z22 and H23 come in a lot as prices have headed South and closed at a recent low on Friday at 189points Z22 over H23. All the other forward months have started to converge this week as prices have dropped.

– This is exactly what happened in the 11/12 inverse season and continued to occur as prices struggled and fell into the seasonal low at the end of the season.

– Here is a comparison of the USDA August and September WASDE’s in 2011 and 2022 shown in the table below. It makes interesting reading! We have also enclosed the charts of the season so far and what happened in July 12 as a reminder of what may happen as the current season progresses

– A few weeks ago we warned of the plight being faced by the “online” retailers following the clear down turn in the world economy. The market valuations of Zalando and Asos are worth 20% and 10% of their peaks at the height of Covid back in the 2nd quarter of 2020!

– Both share prices are at new 2 year lows and look like they have further to fall!

– The S&P 500 fell to a 2022 calendar year low on Friday reflecting sentiment about the economy at large at the present time!

Conclusion

EAP believe that Cotton rallies into the late 80’s and early 90’s will be sold but Cotton in the low 80’s represents short term value. If we are wrong, then a move to 77c/lb can occur! A move back into the 100’s would be surprising, unless end user demand returns in earnest, which we seriously doubt! EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season. Scale up selling from 90c/lb or higher over the coming days (were we to see it) is likely to prove prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.