- Jo Earlam

- July 30, 2022

- 2:16 pm

- 10 min read

Cotton has a positive week but is approaching technical resistance!

Only two things are infinite, the universe and human stupidity, and I'm not sure about the former.

CTZ22 – 96.74 – (+0.53)

CTH23 – 93.51 – (+0.84)

CTK23 – 92.03 – (+0.88)

CTN23 – 90.18 – (+0.87)

CTZ23 – 82.44 – (+0.73)

Zhengzhou CF209 – 14,965 – (+55)

Cotlook “A” Index – 114.10 (+1.30)

Daily volume – 18,327

AWP – 104.48

Open interest – 185,369

Certificated stock – 8,277

Z22/H23 spread – (+3.23)

Z22/Z23 spread – (+14.30)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Cotton traded in a 815 point range between 89.50 and 97.65 before closing up 585 points having moved up every day of the week. This was the biggest weekly gain since the 2nd week of June.

– Daily futures volume averaged a summer doldrum low of 16,619, with options trading less than half the previous week at 5,305 daily. Implied volatility for Z22 dropped 2% over the week but remains high at 42% being well over its normal historical level which is in the low 20’s.

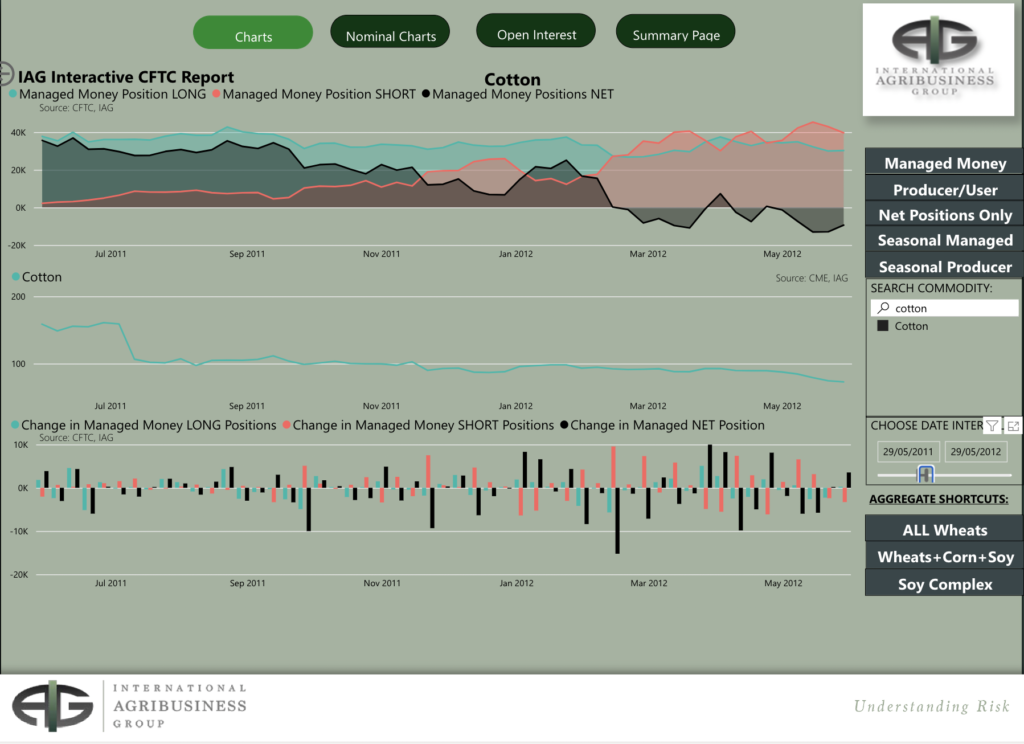

– We have long made comparisons between the 21/22 season to the 10/11 season compared and the current 22/23 season to the 11/12 season. We maintain that viewpoint and believe that the very high volatility we are experiencing will revert back to its normal levels at some point.

– To achieve this Cotton will need to see the high intraday price fluctuations start to go back to the 5 year average of 148 points daily, versus the 360 points daily we have experienced since the spot price moved into the 100’s back at the end of September last year.

– In the 11/12 season, implied volatility was back to the high 20’s by early December and back to the early 20’s by the 1st week of March 2012. If we are right in forecasting that prices will not be in the 100’s for more than a few days only (if at all) and that we will have an inverse season; then expect volatility to continue drop off in the weeks and months ahead. In short summary, expect price protection using options to get cheaper!

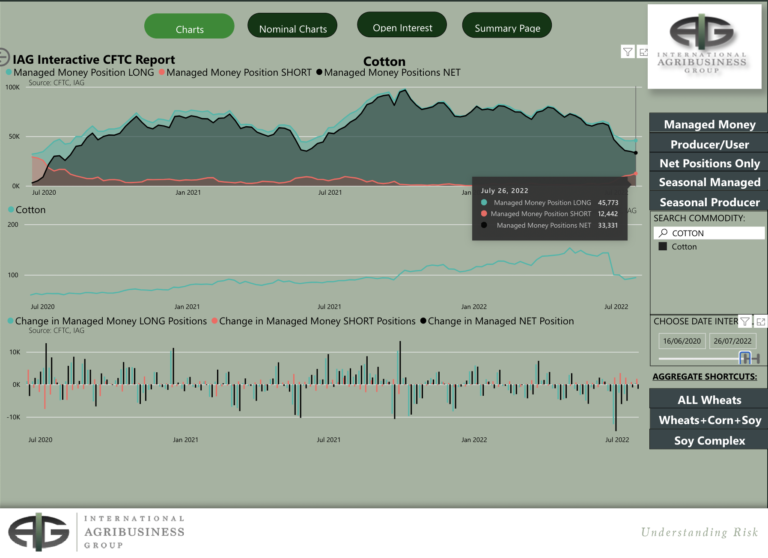

– In the 11/12 season we had the same sort of drought conditions we have now in Texas and an Indian export ban and yet prices still collapsed. Note how Managed Money (MM) will have undoubtedly helped that move by moving from a net long position at the start of the season to a net short position by the end of the 11/12 season. The second picture below is proof of this last point!

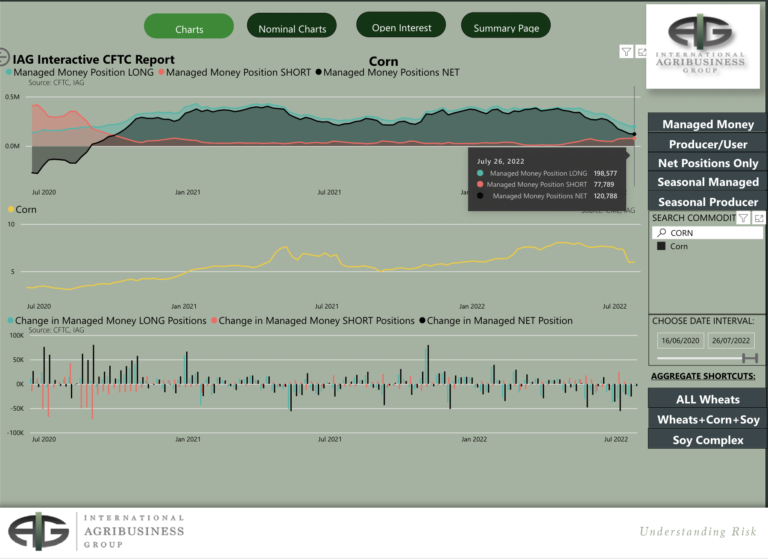

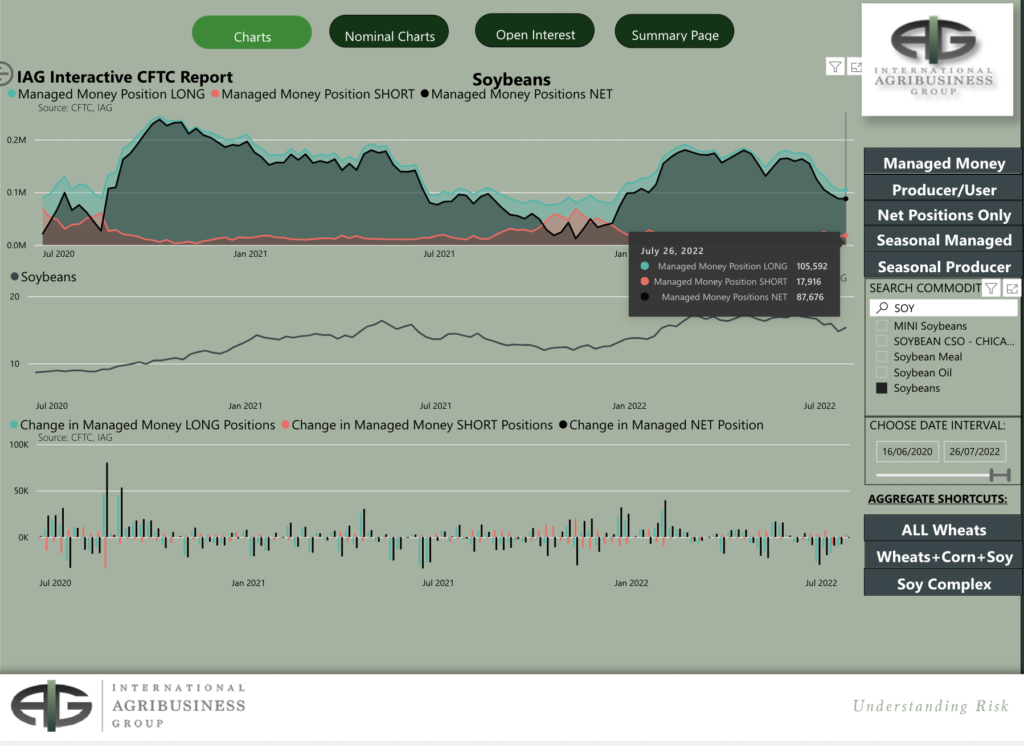

– The CFTC COT report showed little changes week on week with MM holding a net position of 33,311 contracts as of last Tuesday. It is interesting to note how MM have been reducing longs not just in Cotton but Corn and Soy as well and pictorial evidence of the fact is enclosed courtesy of our friends at IAG below.

– From a technical viewpoint, we have been trying to determine the next turning point for Cotton. Since prices bottomed at 82.54 on the 15th July we have seen prices move up for 2 weeks and we anticipate the next significant turning point is likely to be around the end of the month possibly the 3rd August at the latest.

– Using the fibonacci retracement of the Z22 contract high of 133.79 and the recent low of 82.54 the market looks likely to encounter stiff resistance at the 38.2% level of 102.12. This is also close to the 200 day moving average lying at 103.21.

– Traders who are wily and brave enough may choose to fix some of their “on call” sales or buy some downside protection at or around the levels suggested.

– The Dollar Index has continued its counter trend movement to the downside this week and can certainly be considered as at least part of the reason for the strength seen for commodities this week. However we are approaching trendline support and the 200 day moving average which is detailed in the chart below.

Conclusion

Prices have held the recent 82.54 low and a counter trend bounce has occurred which could take prices as high as the low 100’s but is expected by EAP to fail. Potentially, a test of the 200 day moving average is possible fuelled by some courageous end user physical buying and/or a hurricane inspired series of events. However, EAP maintain our longer term viewpoint that a final move to the 70’s will eventually play out by next May and the 22/23 season will prove to be an inverted season.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.