- Jo Earlam

- July 7, 2022

- 10:37 pm

- 10 min read

Holidays are comin'

An investment in knowledge pays the best interest. — Benjamin Franklin

CTZ22 91.88 (+3.27)

CTH22 88.00 (+3.32)

CTK22 85.94 (+3.28)

Zhengzhou CF209 – 16,835 (-20)

Cotlook “A” Index – 134.00 (-4.40) – 6th July

Daily volume – 25,788

AWP – 116.83

Open interest – 173,261

Certificated stock – 15,755

Dec / March spread – (+3.88)

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Fuelled by weakness in the big brothers of soy, corn and wheat (more on this in our weekend report) cotton has been on the defensive all week. Today we saw new life of contract and seasonal lows made basis the front month Dec ’22 at 88.10 usc/lb, where we found strong support with the market rallying to close 378 points higher at 91.88 usc/lb up 327 points on the day.

– In recent times, the traditional inverse correlation between cotton and the dollar has seemed to diverge. However, this correlation seems to have reasserted itself this week as ags have been under severe pressure whilst the dollar index has surged to multi-year highs (below).

– The deadline for Indian imports was this week extended to 31st October. Monsoon rains have been very good in recent weeks and have caught up the June deficit. However, sowing is delayed by around 20-30 days, meaning we are unlikely to see good arrivals until November. When these two bits of news are put together, it would seem there is a pocket of demand uncovered, provided of course one can get cotton to destination in time!!

– Mills in India have shown a little interest in purchases in recent days suggesting the first green shoots of value at these price levels. This is echoed by some tentative positive spinning margins in the Pakistani open end sector. However, mills in the Far East report a comatose yarn market and much reduced capacity utilisation whilst retailers and brands delay shipments in response to bulging inventories in their home markets.

– Meanwhile in Turkey, European orders are slowing down and yarn and cotton stocks are building. Most mills are planning to take an extended break for the upcoming Bayram (Eid al-Adha) holidays – something we will no doubt see replicated elsewhere in the world.

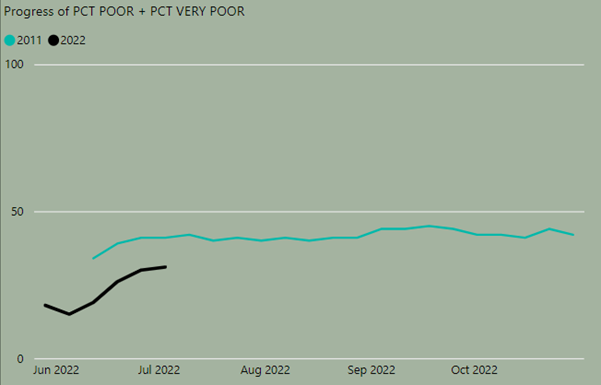

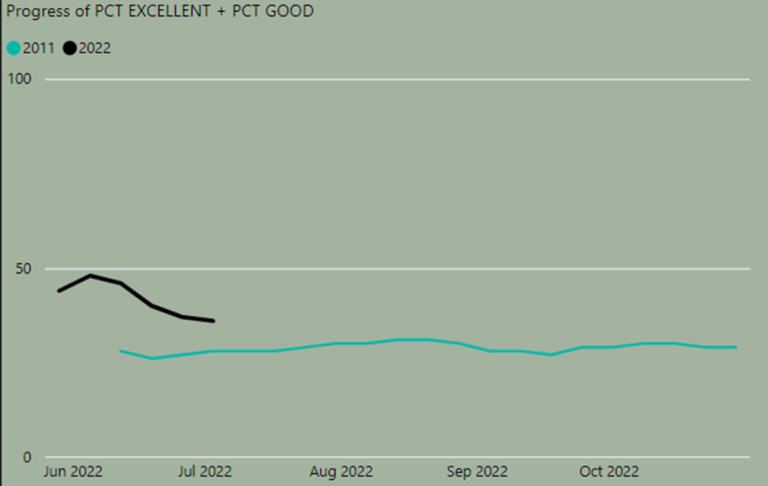

– Regular readers will have no doubt twigged that we see similarities between this season and the 2011/12 season. Below are the charts of the US crop condition ratings for poor & very poor along with those for excellent & good, courtesy of our friends at IAG.

– The USDA export report is delayed until tomorrow due to the July 4th Holiday.

– CFTC cotton on call report, based positions on 1st July showed very little change in positions over the course of the previous week despite the market’s weakness. Over the last week there have been reports of mills beginning to fix and we shall see in next week’s report. Overall, current crop unfixed on-call sales stand at 60,637 contracts which is the third highest for this week of the year.

Conclusion

The market reached a new low today at 88.10 usc/lb and, as we have previously commented, seems to have run into strong support here. The coming days will be crucial to see if the market can hold these levels. Above the market, we see stiff resistance in the early 100’s up to 110c/lb and if we were we to see a rally into this area then we would expect the bear to reassert itself. EAP maintain our viewpoint this will be an inverse season and we have already seen the seasonal high at 133.79c/lb on the 17th May and now think a move to the mid 70’s is likely with timing towards the end of May before the current bear market is over!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.