- Jo Earlam

- June 24, 2022

- 6:21 pm

- 10 min read

Nasty week for Cotton with no bid for speculative longs who get smoked!

You will either step forward into growth, or you will step back into safety – Abraham Maslow

CTN22 – 136.32 (-7.00)

CTZ22 – 102.01 (-6.06)

CTH23 – 97.73 (-5.94)

CTK23 – 95.33 (-5.68)

CTN23 – 93.01 (-5.50)

Zhengzhou CF209 – 18,275 (-240)

Cotlook “A” Forward Index – 130.70 (-3.90)

Daily volume – TBA

AWP – 140.47

Open interest – TBA

Certificated stock – TBA

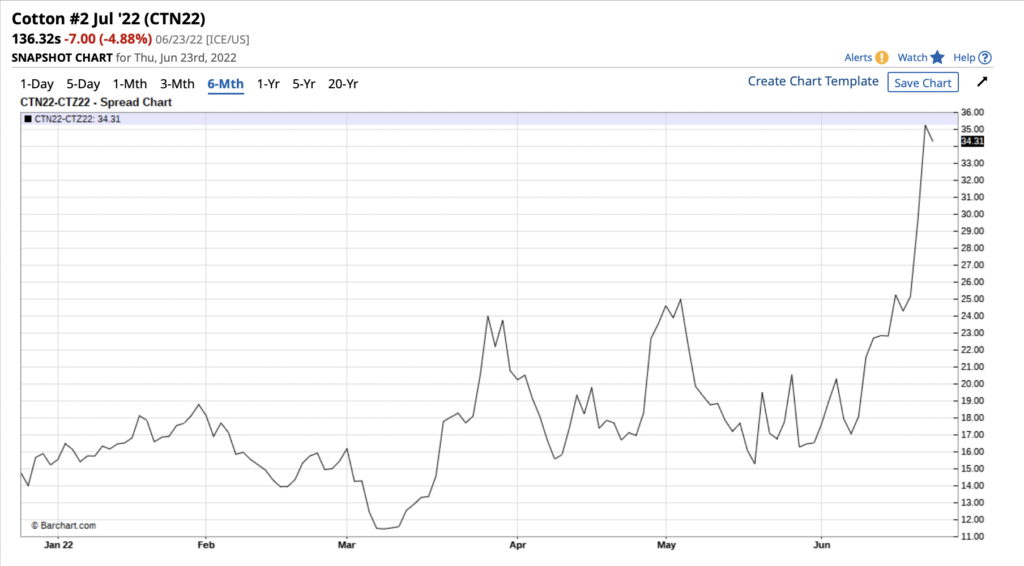

July/Dec spread – (+34.31)

Dec/Mch spread – (+4.28)

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– It has been an awful week for the cotton market with Z22 collapsing to a low of 101.51 from a high of 123.87 for the biggest weekly drop since June 2011.

– Prices closed near to the 101.51 low of the day in today’s trade, leading everyone to question when does the pain stop? More on that later!

– The end user exposed to July on call fixations has been hurt very badly, noting the spread between N22 and Z22 went out to over 35c/lb (N over Z22) this week but with 1st notice day tomorrow, their issue is finally over in view the “on call sales” are cleared up.

– EAP’s efforts will now solely concentrate on Z22 and what is likely to happen in the season ahead.

– The extensive fundamental, statistical, monetary and historical analysis in trying to predict the market has paid off for our clients in the last week, noting we are acutely aware we are not always correct in our analysis!

– It is always important to look at alternative points of view to our own and EAP were alerted by friends this week of a character under the pseudonym of “Grandma” previously advocating the high probability of Z22 going to 150 and beyond.

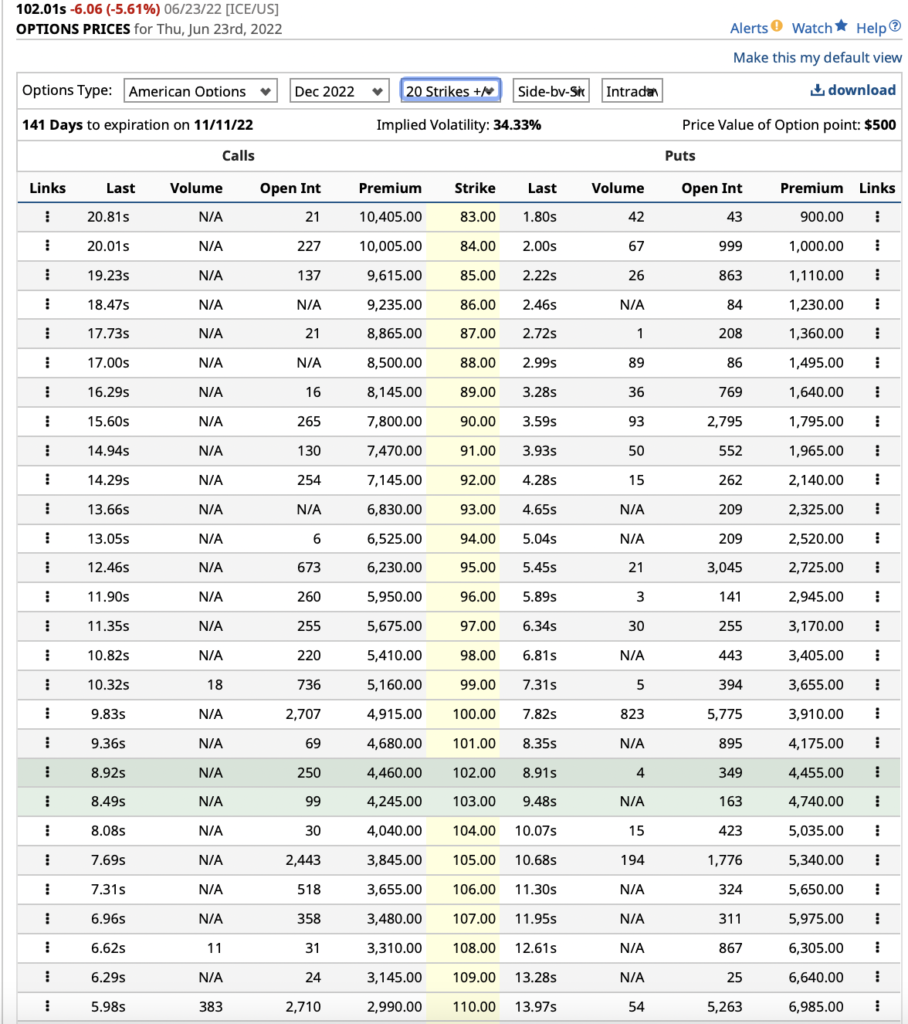

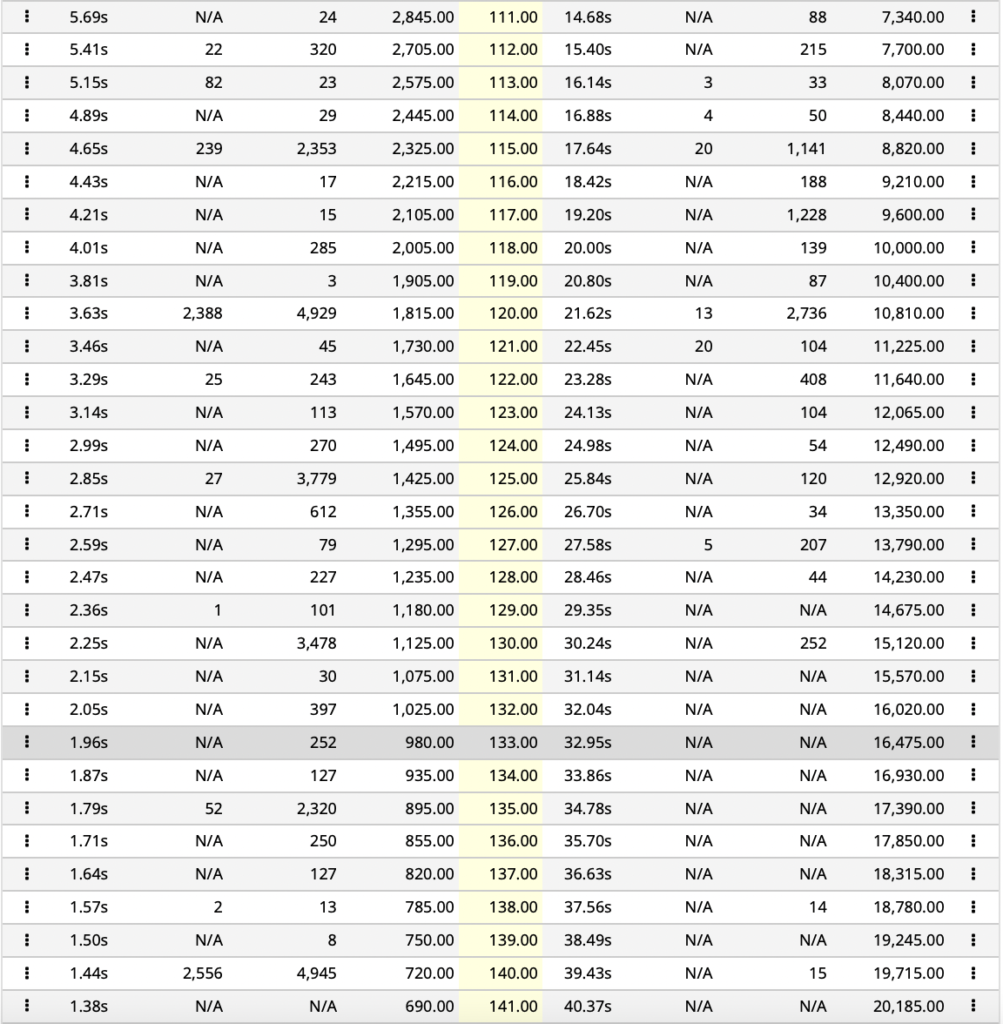

– In fairness, many traders clearly had this opinion, noting that there are bets out to the “250 strike” call option in the December contract.

– Only this week “Grandma” stated and I quote… “she is a solid and steady buyer of Z22 on a scale down basis” which was when the market was at 108c/lb. At some point the bounce will come and “Grandma” could be right for a short while, but will likely forget to mention that her followers are nursing a 32c drop in just over a month based on today’s close….OUCH!!!

– In our last “What’s app” to clients today we mentioned that we should see some support between 103 and 108c/lb but with a close of 102.01 even our own today’s guesstimate has so far proven to be a tad optimistic!

– The above chart of Z22 showed that today’s closing price of 102.01 was even below the 200 day moving average lying at 102.12. This is technically significant and we may even now test the late February 2022 low at 98.88c/lb before we see support.

– Noting the high of 133.79 was on the 17th May we have actually seen a move down of 32.28c/lb in a matter of just over a month and rather staggeringly, a drop of more than 22c in just 3 business days!

– When prices collapsed in Z11 back in early June 2011, the drop was even more calamitous, falling 47.70 c/lb in just over a month. The bounce, when it came, saw a move up of nearly 50% of the move down.

– Lets assume we do see support at 98.88, then this would equate to a move of 3491 points. A 50% retrace of that move might take us back as as high as 116.33 but we somehow doubt that. If and when we get a bounce, then EAP expect it to fail somewhere between 107 and 115c/lb and would be where we would wish to go scale up bearish again!

Conclusion

We are definitely NOT bearish at 102c/lb. We note however that if the rout continues there should be some support at 98.88 down to the original breakout at about 96.50 and expect a meaningful bounce to occur to relieve the oversold condition of the market. However, only when we see the support can we determine the extent of that bounce, noting the tide has firmly turned for Cotton and a lot of the Commodity markets. Considering the magnitude of the drop, we firmly believe this will likely spill over into the same sort of treatment for its big brothers which all had huge upward moves over the last 2 years. As we have previously opined, we think the Cotton season ahead will prove to be an inverse season, where the high comes early (read 133.79 on the 17th May) and a move to the mid 90’s at some point in the season looks on the cards!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.