- Jo Earlam

- June 17, 2022

- 7:52 am

- 10 min read

Wall Street....... at least it's not as bad as crypto

If change is all you require, dwell not on the present or prior, imagine a view where everything is new and make that your only desire.

CTN22 143.53 (+0.35)

CTZ22 119.23 (+1.31)

CTH22 114.88 (+1.33)

Zhengzhou CF209 – 19,695 (-385)

Cotlook “A” Index – 161.30 (-2.25) – 15th June

Daily volume – 24,364

AWP – 134.41

Open interest – 199,231

Certificated stock – 1,087

July / Dec spread – (+24.30)

Dec / March spread – (+4.35)

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The front month Dec ’22 continues to struggle to find any momentum and it is hard to escape the feeling that it is only the soon to be expired July ’22 contract, supported by fixations, that stands between Dec and a larger sell off. Strong export sales to China (below) provided support to the market today, with Dec ’22 closing up 131 points at 143.53, though the wider demand picture is far from encouraging.

– As can be seen from the below charts, equities markets are having an ugly time of it. Some comfort was provided yesterday when the Fed increased rates 75 percentage points which was in line with expectations. Cotton traditionally correlates strongly to equities, though this relationship has notably broken down recently. If gravity does reassert itself however, the landing for cotton could be a hard one!

– In China domestic and CZCE prices continue to fall and there remains upwards of 2 million MT of Xinjiang cotton unsold. Xinjiang cotton is trading delivered east coast mills at 21,000 RMB/MT, whilst yarn is trading at 28,200 RMB/MT. As a rough estimate, this is slightly below break-even, but by no means catastrophic. However, demand is slow and both the cotton and yarn prices have been falling.

– Meanwhile, the fall in Chinese yarn prices is impacting demand for imported yarn from markets such as Vietnam. In addition to the fall in demand for cotton which this is bringing about we are also now seeing Vietnamese yarn being offered aggressively into non-traditional markets such as India and Bangladesh, competing with the locally produced yarn in these countries.

– As can be seen from the chart below, the Indian monsoon onset is slightly behind the normal pace but is making steady progress across the country. Sowing was a little delayed due to the late onset and, in certain areas, farmers have been advised to delay slightly in order to aid in pest management. So far there are no major concerns and, with a reduction in US supply this season, the market will be hoping it stays that way.

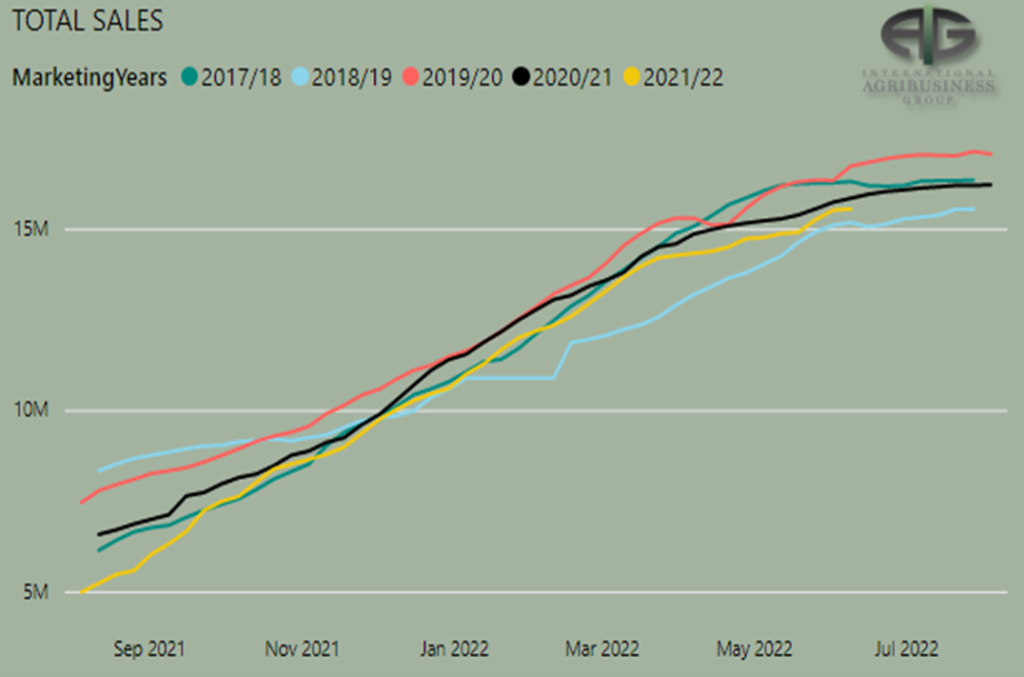

– The USDA export report showed a much more credible 26,500 bales for 2021/22 crop. We remain somewhat suspicious of the 380,200 bales for new crop of which 363,700 bales were to China, though there are circumstances, such as larger, long term “block” purchases that may occur at times regardless of the general market demand outlook, that could possibly explain this. Exports 335,800 bales continue to lag and it seems likely the USDA will require a downward revision to their 2021/22 target.

– The CFTC cotton on call report based positions on 10th June gave a good display of the support to N22 as 10,474 contracts were fixed over the course of the week. The N22 position now stands at 16,224 contracts. Reassuringly this has now dropped to the 3rd highest position for this time of year, but with 9 trading days from the report to the last day prior to FND there remain 1,803 contracts a day to be fixed!

Conclusion

We maintain that involvement in N22 is something one should by now have no part in, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago. Any bounces in Z22 to 122c/lb up to 130c/lb were we to get them, should be sold in our humble opinion.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.