- Jo Earlam

- June 12, 2022

- 4:20 pm

- 10 min read

Are we about to see a very similar pattern to 2011 when N rolled to Z?

General George Marshall—the U.S. Army chief of staff who oversaw Allied strategy and who Churchill called the “organizer of victory” of World War II—once told his wife, “I cannot allow myself to become angry. That would be fatal. It is too exhausting.” It’s true. Anger kills your energy, your health, your performance, your professional reputation, your relationships, and our society.

CTN22 – 145.06 (-1.45)

CTZ22 – 122.36 (-2.57)

CTH23 – 117.84 (-2.27)

CTK23 – 114.39 (-2.08)

CTN23 – 110.80 (-1.78)

Zhengzhou CF209 – 20,325 (-55)

Cotlook “A” Index – 159.10 (+3.75)

Daily volume – 55,972

AWP – 134.41

Open interest – 211,998

Certificated stock – 1,087

July / Dec spread – (+22.70)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– The switch from old crop N22 to new crop Z22 certainly did not disappoint this week with extreme volatility happening as expected. For the record, old crop N22 traded in a 1160 point range between 136.10 to 147.70 before closing the week up 688 points at 145.06 from the previous week’s close. Open interest in N22 is down to just over 48k with just 1 more day to go until the end of the GSCI roll period.

– New crop Z22 was marginally less lively with prices trading in a 894 point range between 117.06 and 126.00 before finishing the week up 446 points at 122.36.

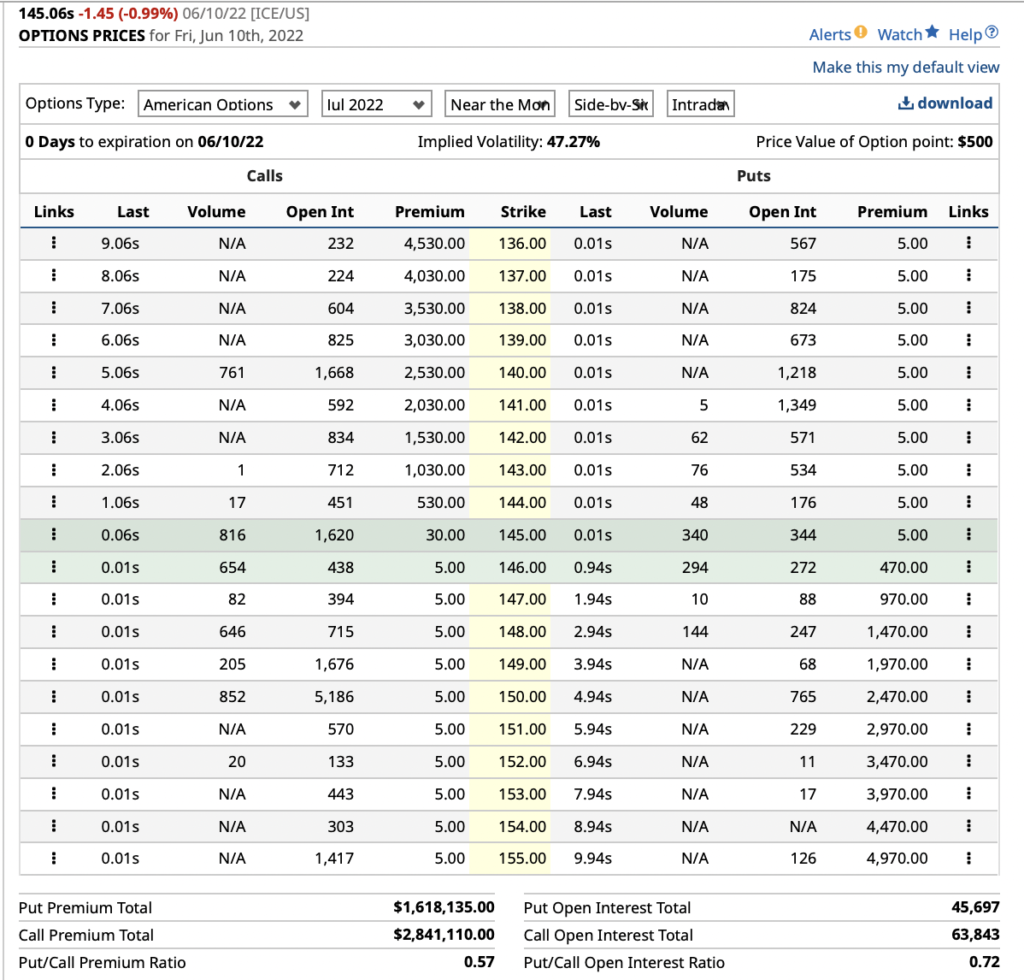

– Volume was impressive averaging 43,472 futures daily and also saw July options expiry that will see many holders of long calls severely disappointed (read lost a lot of money) noting there were open call options out to the 195 strike!

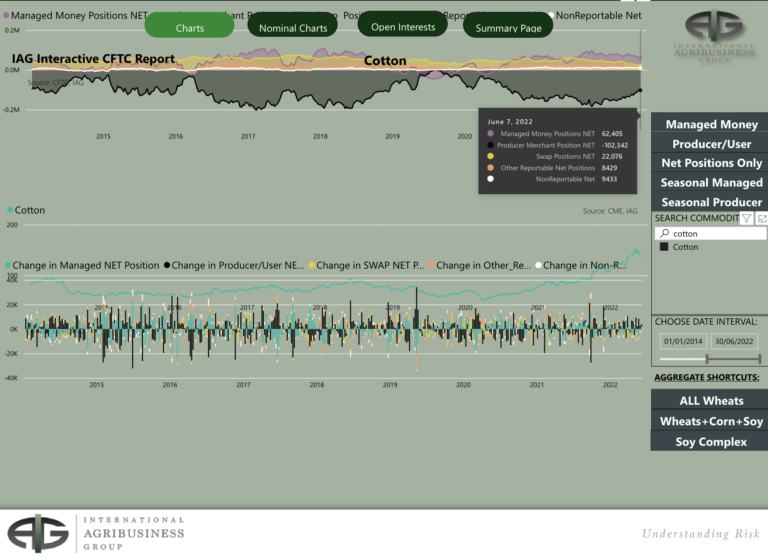

– The CFTC COT report showing traders positions as of last Tuesday showed Managed Money (MM) to have been net buyers of 2,071 contracts taking their net long to 62,405 contracts. On the other hand, Other Reportables (OR) were net sellers of 2,229 taking their net long to 8,429 contracts. Between MM, OR and NR their net long is now 80,267 contracts.

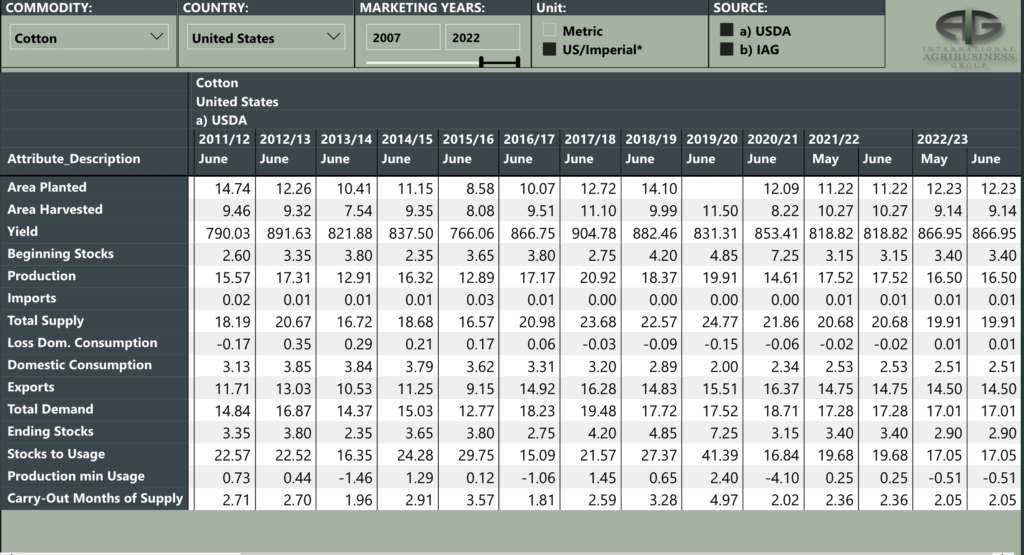

– Friday was June WASDE day but nothing much changed with the exception of some bewildering historical revisions. In fact, 2022/23 changed only minimally with a net decrease in ending stocks of 47,000 bales globally. Nevertheless, this is a cotton market report so we are beholden to attempt some enlightening comments….. The one thing that does stand out are the changes to the 2021/22 balance sheet, though the net change in ending stocks was a 702,000 bale decrease, this was achieved by a reduction of 1.5 million bales to production offset by a reduction of 1.25 million bales in consumption, which puts us in mind of a favoured saying of ours: SnD’s are not the WASDE, they represent the buyers’ ability to buy and the sellers’ ability to sell.

– So what do we mean by this? Put simply, the change in the USDA ending stocks may be fairly neutral, but ending stocks are simply a reflection of the situation on 31st July, not the ebb and flow during the season. The cuts in production came primarily from India and Brazil. Therefore, although the USDA is only now recognising the fact, these bales have not been available for the buyer to buy since harvest and this reality will have been priced in to the market.

– On the other hand, the drop in consumption is a much more recent phenomenon, so it is only recently that we are seeing this pressure on the sellers’ ability to sell (regardless of what people may be telling the USDA on a weekly basis). In other words, it is the consumption cuts, that will be impacting price today.

– There are 2 charts detailed below. The first shows Z22 from the 1st January this year which shows the movement from just under 95c/lb to its life of contract high so far at 133.78 seen on the 17th May this year.

– The second chart is the chart of Z11 over the same time period. It was a more volatile time than even the current season and like today we saw a rise from just under 100c/lb to a high on the 6th April at 144.66 and a near retest of this high in the 1st week of June.

– It was in fact the highest any December contract has ever traded in modern history and is part of the reason we feel Z22 will struggle on any retest of the 133.78 life of contract high and whether we see it all?

– The below chart is of Z11 into expiry and note how it went straight back to below what it started the calendar year at, which was also in the face of a historical West Texas drought. Will we see history repeat itself?

– We also include a comment from a broker friend (Hibbie Barrier) from the 12th July 2011 which read as follows….I quote…”Since its June 3rd high at 140.90, prices have lost 36.51 cents or 26%. Clearly cotton’s fate has changed going from darling to dog in no time flat even as we stare down a historical drought in West Texas”

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago. Any bounces in Z22 to 122c/lb up to 130c/lb were we to get them, should be sold in our humble opinion.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.