- Jo Earlam

- May 21, 2022

- 8:17 am

- 10 min read

Goodbye to old crop! What's in store for 22/23?

Those that mind don't matter and those that matter don't mind!

CTN22 – 142.27 (-5.43)

CTZ22 – 125.18 (-3.04)

CTH23 – 120.84 (-3.09)

CTK23 – 116.76 (-2.95)

CTN23 – 112.69 (-2.78)

Zhengzhou CF209 – 21,195 (-55)

Cotlook “A” Index – 164.00 (-4.00) – From the 19th May 2022

Daily volume – 24,854

AWP – 143.24

Open interest – 201,851

Certificated stock – 1,0881

July / Dec spread – (+17.09)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Another week has passed which saw wild swings intraday for both old crop July and new crop December, with N22 moving on average 592 points daily and new crop Z22, 392 points daily. By the close of the week, July finished the week down 293 points having traded in wide range of 1083 points between 141.12 and 151.95 on average futures volume of 30,285 contracts.

– For new crop December, a new life of contract high was made at 133.79 on Wednesday, but sold off quite strongly by the end of the week to close down 281 points, having traded in a 950 point range between 124.29 and 133.79. As we pointed out in Thursday’s report, Z22 is the effective front month on account of holding the highest open interest and will continue to gain over N22 in the days ahead, as bets are unwound into the new crop.

– We have included below a chart of Z22 and within it have highlighted the low of the contract just under a year ago at 77.00 in June 2021 to the recent high of 133.79 seen last week. Prices remain far above the longer term 100 and 200 day moving averages. Contract highs and lows are most popular in May and March months of the year on an historical basis and we maintain our belief that in a few months time one will look back at this time and find that prices will prove to have been fully valued at current levels. Time will tell if we are proven to be correct or otherwise!

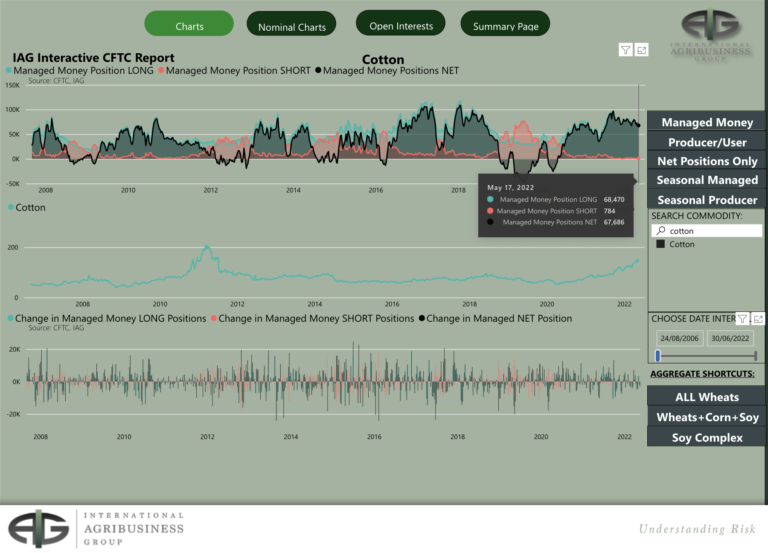

– The CFTC COT report after the close showed that managed Money (MM) continue to unwind some of their substantial long positions. Between MM, OR and NR their overall net long is down to 90,024 contracts or just over 9 million bales primarily in the new crop contract.

– Thanks as always to IAG for pictorial evidence of the fact!

– In our Thursday report we looked at the demand side of the balance sheet, focusing on the end user. For balance it is also worth taking a look at the supply side of the equation. As we mentioned, Texas is, rightly, taking much of the attention. For the 2021/22 season Texas produced 8 million bales out of a total US crop of 17.5 million. It is worth noting that for much of the early 2021 there were concerns as to severe dryness in Texas only for late rains to “save” the crop, though admittedly the situation is worse now than it was at the same point a year ago.

– The smallest Texas crop in recent years came in at 3.5 million bales in 2011, and we have commented often in these pages on that season’s price action which literally saw a collapse in prices from the end of June that year into the middle of July. The overall US crop that season was 14.7 million bales, somewhat lower than the USDA current estimate for 2022/23 which stands at 16.5 million bales. The lowest US crop of recent years was 12/5 million bales in 2015/16 when the Dec contract went off the board in the low 60s.

– In the Southern Hemisphere things are (so far) looking good. ABRAPA’s most recent report maintains a crop just below 13 million bales. The crop is already well committed for the earlier shipment months and it is also worth noting that there are concerns we may see a reduced number due to adverse weather conditions in April. Australia, meanwhile, is looking at a 5.5 million bale crop, whilst this has been well publicised it is certainly not to be sniffed at.

– Planting is underway in North India and about to start in the Central regions. Farmers have been happy with their returns and acreage will be maintained. As always in India much will depend on the monsoon and in recent years we have seen issues with pest infestations effecting yield. At this stage we would be hesitant to call a crop number, but the early outlook is for an increase from 2021/22.

– Reports from Pakistan are mixed, the country is currently suffering an intense heatwave, but we have also heard reports that this has in fact helped irrigation due to an increase in snow melt. Early signs seem cautiously optimistic, but we should also note that Pakistan has struggle with yield in recent years, so we watch and wait.

– The Chinese crop is off to a healthy start and our early estimate is for a crop of around 27 million bales. The Chinese crop is now overwhelmingly produced in Xinjiang, the acreage is relatively fixed in the province and, with irrigation coming from snow melt, there is less room for production shocks.

– Last, but certainly not least, West Africa does seem to be in for a production decrease. Farmers seem to be turning away from cotton and we are hearing reports of a decrease in acreage anywhere from 10% to 20%.

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.