- Jo Earlam

- May 19, 2022

- 8:47 pm

- 10 min read

Do not lose sight of the end user

Everybody is a genius. But if you judge a fish by its ability to climb a tree, it will live its whole life believing that it is stupid. — Albert Einstein

CTN22 147.70 (+3.23)

CTZ22 128.22 (-0.96)

CTH22 123.93 (-0.18)

Zhengzhou CF209 – 21,220 (-140)

Cotlook “A” Index – 161.70 (-2.45) – 18th May

Daily volume – 39,566

AWP – 140.82

Open interest – 202,925

Certificated stock – 1,088

July / Dec spread – (+19.48)

Dec / March spread – (+4.29)

July Options Expiry – 10th June 2022

July 1st Notice Day – 24th June 2022

September Options Expiry – 19th August 2022

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– In the last couple of days Dec ’22 has overtaken July ’22 in open interest and become the de facto lead month. July ’22 has spent the week displaying why it is not a contract to be exposed to. Starting the week up sharply in early trading on the back of the Indian wheat export ban, we have had 3 figure moves up or down each day this week, closing today at 147.70 up 323 points on the day, but only 250 points above Friday’s close despite the 1083 point range for the week so far (below chart).

– Dec ’22 has traded a 739 point range, with today’s 96 point fall to 128.22 almost completing the return of Monday’s gains, being just 23 points above Friday’s close.

– As lockdowns continue in China and consumption nose dives, a good portion of the 350,000 MT or so of stock held in consignment warehouses is being offered into the export market. From past experience we can tell you that this is not a cheap, or easy exercise and is very much a last resort for the holders of unsold stocks. India is of course a logical destination, but is logistically challenging. Some homes are being found in SE Asia where, whilst demand is not great, some mills do need to fill gaps in coverage created by late shipments from elsewhere.

– Further evidence of the adverse situation in China came in the economic data issued earlier this week. Most notably, retail sales fell by 11.1% year on year. Whilst we still look to the US (and behind it Europe) as the leading drivers of cotton demand, on an absolute level Chinese consumption accounts for an ever increasing share. In fact, based on data from Statista, overall apparel sales in China for 2022 were estimated (pre-lockdowns) at US$ 319 bn, compared to US$ 335 bn in America. It is outdated to simply look at the lockdowns in China as a case of switching western focused demand from one producing centre to another. Issues in China now have a significant impact to total end user demand.

– In the UK inflation reached 9% in April, which is the highest reading in 40 years. Globally inflation is set to eat further into end user demand for textile goods. At the same time, Walmart shares suffered their largest one day drop since 1987 after slashing earnings guidance. Much of the focus for Dec ’22 is on the drought in Texas, and the map below shows that this is not without justification. However, it does seem to us that the focus on production concerns is overshadowing the potentially more significant, drop in total demand. US new crop sales have been strong so far and perhaps this is allowing a false sense of security, but at consumer level the alarm bells should certainly be ringing!

– The CFTC Cotton-on-Call report, based positions as of 13th May, showed further reductions in July ‘22 net on call sales positions of 4,523 contracts. Nevertheless, the position still stands at 45,817 contracts, with just 28 trading days until FND!! Unfixed July on call sales now stand at 57% of July open interest!!!

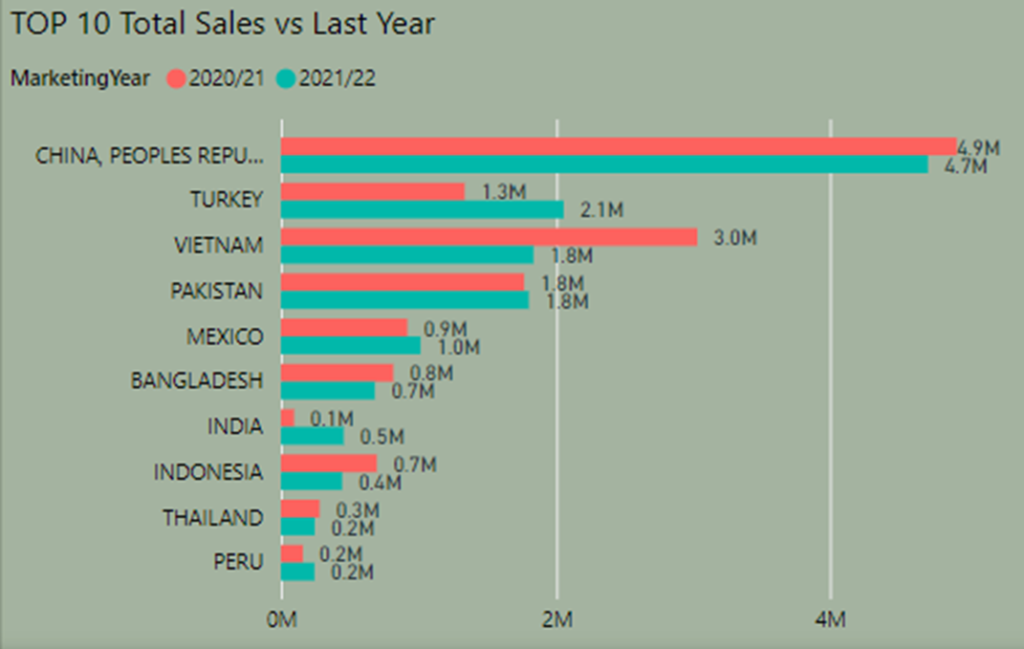

– This week’s US Export Sales Report picked up again on the back of sales to India and Vietnam. Total net sales for 2021/22 were 110,900 bales including 34,100 bales to India and 31,100 bales to Vietnam. Sales for the 2022/23 crop year were notably low coming in at 25,400 bales. Exports continue to lag at 343,200 bales and it certainly seems we will require a downward revision to the USDA estimate if this does not improve soon.

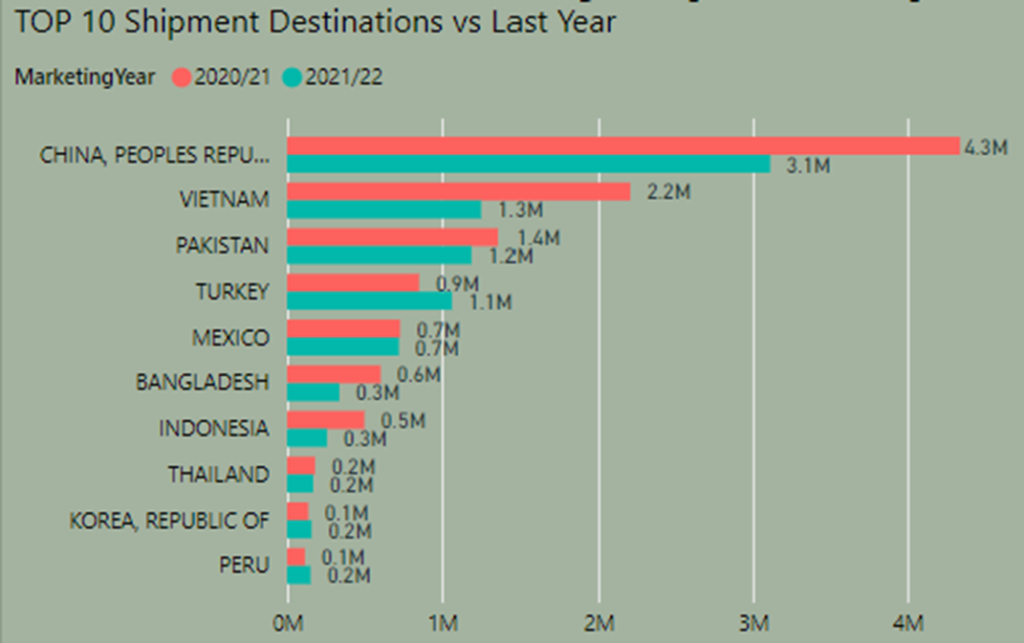

– Noting the above comments that China is actively shipping out cotton from FTZ warehouses a look at the outstanding Chinese commitments is worthwhile. To date a total of 4.7 million bales have been sold to China for the 2021/22 crop year whilst 3.1 million bales have been shipped, leaving a balance of 1.6 million bales. These bales would seem, at the least, unwanted and it is worth watching closely as to whether these contracts are indeed fulfilled.

Conclusion

We maintain that involvement in N22 is something to avoid if possible, but for new crop December we maintain this contract is very fully valued above 125c/lb and the recent spike in N22 offered a golden opportunity to lock in a good proportion of new crop sales 25c/lb higher than one could get just 6 weeks ago.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.