New Special Study

Strategy for hedging on Cotton back in June when EAP expected a swift fall in the price of Cotton

- Jo Earlam

- July 6, 2022

- 3:04 pm

– Back on the 6th May 2022 EAP wrote in its weekend market report the following. Please click here to see what we were saying…

– In addition of the key points made in early June was the following…Cotton had been trading in a channel until late May before breaking to a recent low at 114.92 on 2nd June. The bounce back and subsequent retest of the upside of the trading channel is a classic test and failure with today’s action a new low and close below the 2nd June low. Odds dictate that we now test below 110c/lb and in quick fashion! The money is long and largely wrong now and a risk off mentality will likely prevail noting EAP comments from the weekend. Stay short expecting 110c minimum and maybe 103 to 108 range area before any meaningful bounce!

– Between early May and 1st week’s of June, EAP noted that there was a distinct skew to the “out of the money” calls compared to the “out of the money” puts and felt there was some merit in buying an “at the money” put option in Z22 and help finance it by selling an “out of the money” call option in Z22 which is what one of our clients chose to do.

– At the time we felt with volatility at 35.76% that it was clear put protection was expensive and we noted how the out of the money calls were much more expensive than the comparative out of the money puts. For instance the 140 call closed at 760 points (16c/lb out of the money) whilst the comparative put that was trading 16c/lb out of the money was trading at 506 points. We suggested buying 1x an “at the money put” i.e. the 124c/lb put for 12.76c/lb and at the same time to sell 1x 140 ℅ for 7.60c/lb. Excluding dealing costs and spreads this strategy cost 5.16 c/lb. Note how there were 188 days to Z22 option expiration.

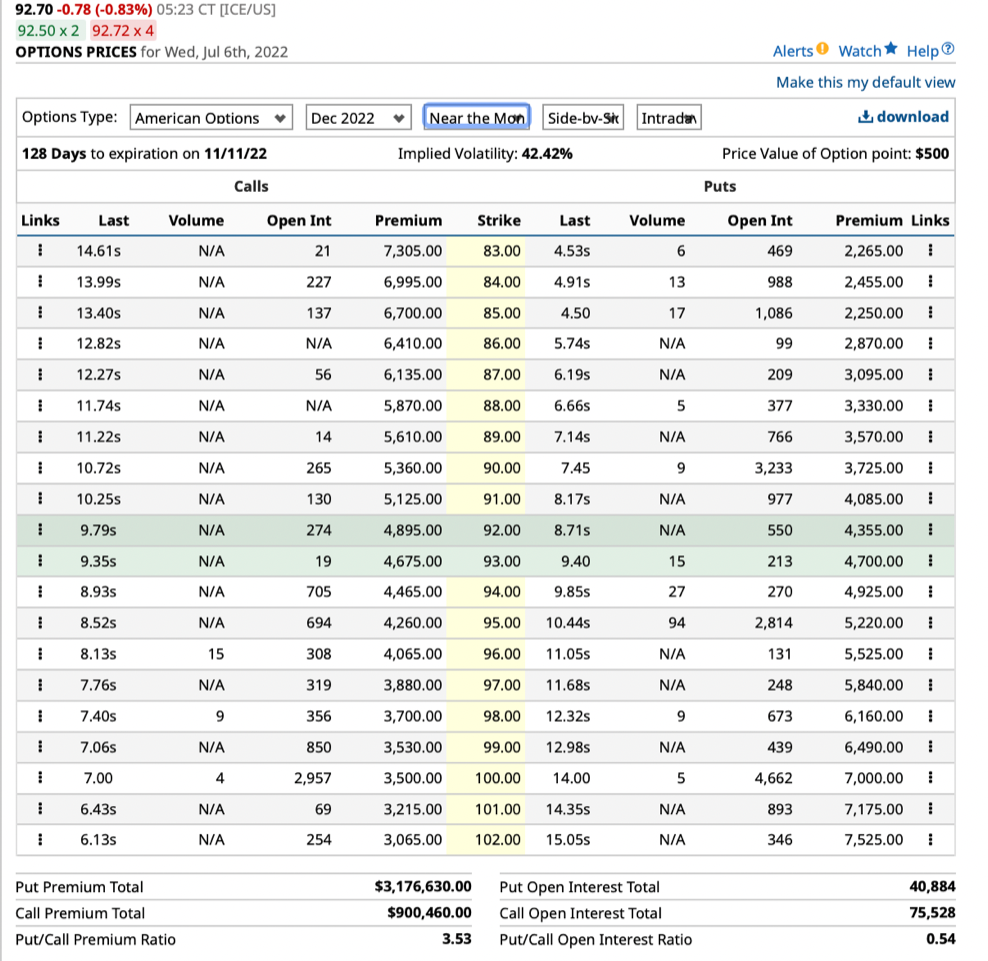

– Here is the price of Z22 today and some of the options noting the price of Z22 is over 30c/lb lower in under 2 months

– The price of the 124 put today is 33.14c/lb and the 140 ℅ is 1.14c/lb meaning the structure is worth 32.00c/lb, being more than 6x its original cost. i.e. based on today’s prices the trade made 6x the cost.

– The skew that was to the calls, is now far more evenly balanced and on the basis we see value in the market short term at present levels, we would buy back the short call, roll down the 124 put into 3x a lower strike (giving 3 x as much downside protection) and turn the whole structure into a put spread.