- Jo Earlam

- December 10, 2022

- 10:12 am

- 10 min read

USDA adjusts World consumption but they are still way off the mark!

There is nothing new in the world except the history you do not know!

CTH23 – 80.95 (+0.10)

CTK23 – 80.90 (+0.25)

CTN23 – 80.66 (+0.27)

CTZ23 – 78.32 (+0.29)

Zhengzhou WQK23 – 13,745 (+125)

Cotlook “A” Index – 98.90 (-1.05)

Daily volume – 32,841

AWP – 73.03

Open interest – 196,545

Certificated stock – 8,901

H23/K23 spread – (+0.05)

K23/N23 spread – (+0.24)

N23/Z23 spread – (+2.32)

January Options Expiry – 16th December 2022

March Options Expiry – 10th February 2023

March 1st Notice Day – 22nd February 2023

Introduction

– Cotton traded in a 629 point range in the last week before closing down 225 points at 80.95 following publication of the bearish December WASDE on Friday. Futures volume was similar to last week at 26,640 futures daily and noticeably the spreads between March, May and July have almost come into even over the last week!

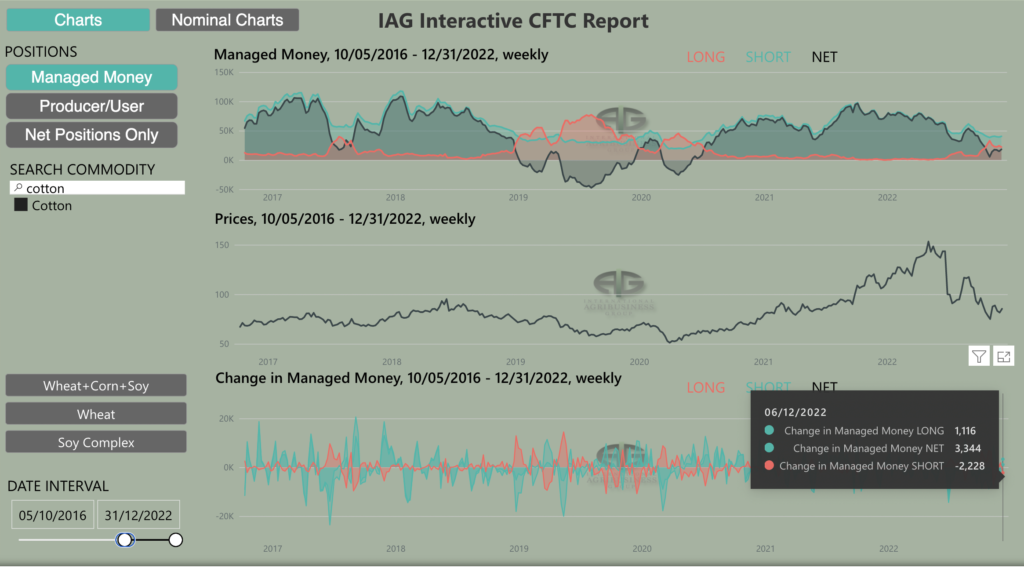

– The weekly CFTC report showed Managed Money (MM) were 18,257 contracts net long in cotton as of last Tuesday. That was a week-to-week increase of 3.3k contracts mostly via short covering.

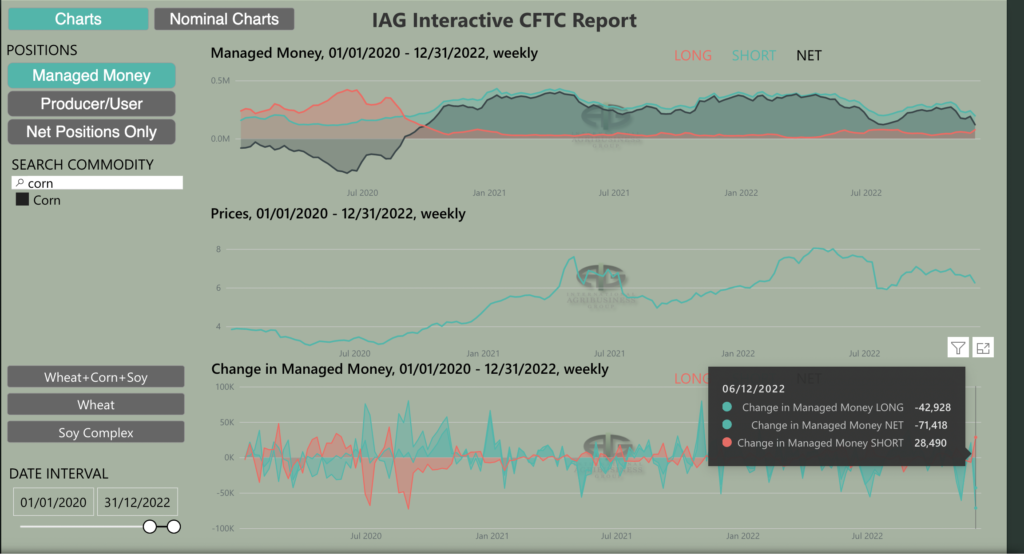

– Thanks as always to our friends at IAG for their new and better pictorial evidence of the fact

– The publication of the December WASDE saw the USDA raise the average U.S. cotton yield by 13 pounds per acre to 868 and the highest yield since 2018.

– The USDA continued to move in the right direction on global consumption. Regular readers will be aware that we are well below USDA on global consumption and we have recently revised our estimates down further. Of course our preference would be to see a large revision, but the USDA generally take a more gradual approach so we can not be too critical in this regard.

– Global consumption was revised down 3.25 million bales with the two largest reductions coming in China and India with a million bales each. EAP and USDA are now broadly aligned on China current crop numbers, which is perhaps the first time we have ever found ourselves in this situation!

– We continue to disagree with the historical stock numbers and are almost 8 million bales lower on China ending stocks! We have written previously on the China stock situation so will not delve too deeply at this time, but if there really were over 37 ½ million bales of stocks in China then surely the recent reserve purchase would have been mush more heavily subscribed.

– In the US production was increased to 14.2 million bales which we find it hard to agree with. Whilst we believe that good conditions in the delta mean that some of the more apocalyptic calls on the US crop will be proved to be wide of the mark, the well known conditions in Texas make it hard to envision a crop north of 14 million bales.

– The market is trading sideways and has averaged a wide 330 point intraday range over the last week and we expect this volatile price action may continue for a little while longer!

– However as the days and weeks progress we fully expect things to calm down with market participants slowly coming to the realisation that Cotton is unlikely to break out to the upside whilst demand continues to be so subdued.

– Having spoken to many market participants over recent days a change in sentiment towards Cotton may only come as late as the 3rd quarter of 2023 and a much less volatile market should not be a surprise to readers of this report in the months ahead!

Conclusion

The cotton market has found resistance just under 90c/lb basis H23. We maintain that for H23 we see prices in the mid to high 80’s as fully valued and any move for this contract into the 90’s as an outright selling opportunity for the rest of the season ending 31st May 2023. Our bearish stance is based upon a lack of demand which will eventually be addressed by continued monthly WASDE reductions to world consumption. We would not want to be short Cotton long term under 70c/lb but feel a sideways market is likely for the rest of the 22/23 season!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Jo Earlam

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.