CTZ22 96.54 (-0.38)

CTH23 93.67 (-0.39)

CTK23 91.49 (-0.35)

Zhengzhou CF301 – 14,175 (+75)

Cotlook “A” Index – 111.95 (-2.65) – 21st September

Daily volume – 21,718

AWP – 95.17

Open interest – 214,256

Certificated stock – 4,552

Z22 / H23 spread – (+2.87)

Z22 / Z23 spread – (+16.01)

December Options Expiry – 11th November 2022

December 1st Notice Day – 23rd November 2022

Introduction

– Yesterday’s limit up move, which many attributed to a possible hurricane forming (red X below), left some of the more optimistic market participants thinking we may have left last week’s rout behind us. At EAP we do not share this view, but time will tell. The market did attempt to push on from yesterday’s strength but was unable to hold early gains and closed today at 96.54 basis the lead Dec ’22 contract, up 38 points for the day.

– Reports from our good friends in Vietnam this week are particularly concerning. Many of the smaller mills are closed, of those larger mills still open, only a handful are operating above 50% of capacity and all are loss making at present. As previously reported, yarn demand from China has dried up due to the low cotton prices in that country and mills are desperately seeking new markets, many of whom have their own yarn gluts to deal with.

– We are hearing that many major merchants have cotton afloat sold to Vietnam which some mills are either unwilling or unable to open letters of credit for at the contracted price. Some contracts are being renegotiated either with the merchant taking a straight up hit, or with the balance to be worked off over time. Other contracts, however, seem doomed to outright default with the cotton having little choice but to go into a bonded warehouse. These warehouse stocks are facing only hand to mouth demand at deeply discounted prices.

– In our weekend report we talked about declining consumption and good production prospects in Turkey. On the back of this (the outlook, not our weekend report!!), a number of international merchants have stepped in and we have heard reports of large volume sales of Turkish cotton to Pakistan this past week.

– As expected, the Fed increased rates 0.75 basis points this week. Fed Chairman Powell commented that there is no “painless” way to tame inflation, which is hardly bullish cotton demand!

– Against the ongoing US dollar strength, the Chinese Yuan has broken through the level of seven to the dollar. This is the first time we have reached these levels since July 2020 and the CNY has only spent a brief time above this level since first breaking below it in March 2008 on the back of currency reforms in China.

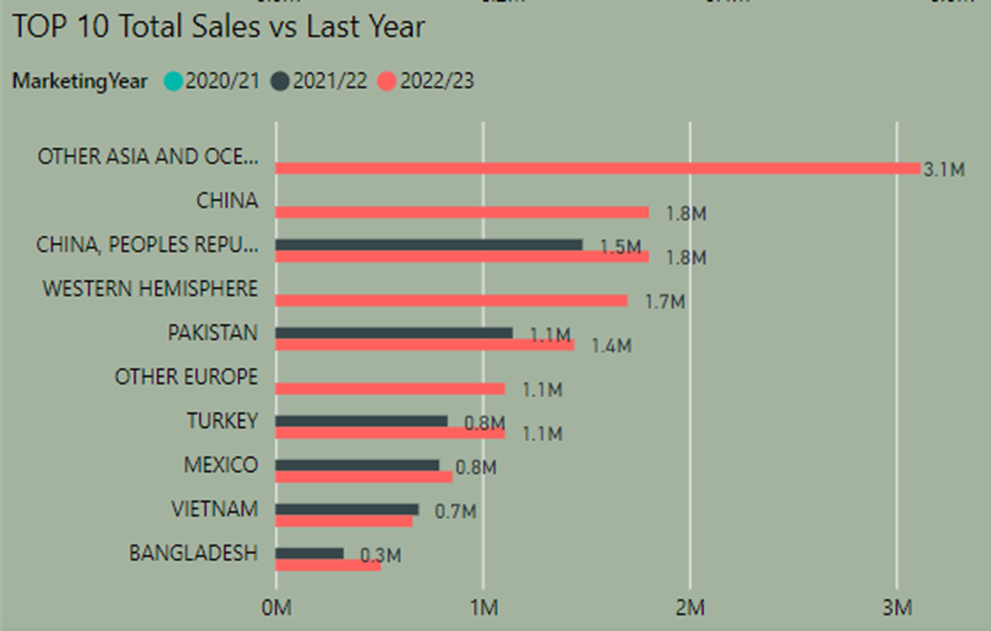

– The USDA export sales report dated the week ending 15th September was a disappointing one – though, for once, representing the actual market conditions for the week in question. Net sales for the current marketing year were 32,400 bales, of which Pakistan was responsible for 27,800 bales. For the next marketing year 13,300 bales were reported with only two buyers: Pakistan, again, with 8,800 bales and Guatemala taking the balance. Exports were reported at 232,300 bales for the week.

– CFTC cotton on call report, based positions for the week ending 16th September showed almost no change week on week. The overall net on call sales position for current crop increased by only 85 contracts to 68,336 contracts which is the 5th highest position for this week of the year on record. The position remains heavily skewed to the Dec ’22 where it stands at 34,126 contracts compared to 34,210 contracts for the March, May and July positions combined.

Conclusion

EAP believe that any rallies in the Cotton market, up to the 200 day moving average at 105.96 should be sold. We would be surprised to see Z22 exceed the nearby at 108.10 for the rest of this season. Longer term, EAP remain of the belief that the 22/23 season will prove to be an inverted one, with the final low at the end of the season. Scale up selling into any strength over the coming days will likely prove to be prudent.

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.