CTN23 81.76 (+3.00)

CTZ23 81.40 (+2.36)

CTH24 81.16 (+2.09)

Zhengzhou WQU23 – 15,620 (+250)

Cotlook “A” Index – 92.95 (-1.20) – 3rd May

Daily volume – 42,296

AWP – 66.53

Open interest – 176,222

Certificated stock – 75

N23 / Z23 spread – (0.36)

Z23/H24 spread – (0.24)

July Options Expiry – 9th June 2023

July 1st Notice Day – 26th June 2023

Introduction

– After the weakness of the last couple of days we doubt many of us were expecting a limit up move today. The market opened strongly, perhaps in line with the post-holiday strength in China’s CZCE, and surged higher on positive export sales and shipments (below). The front month N23 closed up the 3-cent limit at 81.76. The next question is do we see the move follow through or is this a false dawn? Much attention will be on whether the forecasted rains in Texas (2 week outlook below), come to fruition.

– The Federal Reserve raised rates by a further 0.25 basis points to 5.25% yesterday. This is the tenth consecutive raise, but the Fed also relaxed its guidance from March and hinted that a pause in the rate rises may be coming.

– In a parallel move the ECB, today, increased its own rates by the same amount to 3.25%, but also tempered this with comments which were interpreted by many analysts as dovish and an indication that European borrowing costs may soon reach their peak.

– Yarn demand has slackened across the board over the last ten days. Of late the most promising news has come from India where mills have been operating up to as much as 95% of capacity. However, even this market has reported a drop off. This is, in particular, impacting the southern mills which are more often yarn only spinners as opposed to their more integrated counterparts found in the north.

– Brazilian exports continued to slacken with only 61,000 MT shipped in the month of April. Total exports for the MY to date stand at 1.257 MMT, against the USDA estimate of 1.676 MMT. We would expect the volume of shipments to increase given the recent aggressive offerings, but we would need a pace of 140,000 MT per month for the final three months of the year, a volume not seen since December.

– As we have reported on more than one occasion recently, major merchants are ever more aggressive on their Brazilian offers, in particular on those lots that have been put afloat due to the need to move them out of country, where storage is both tight and expensive. In recent days we have heard small volumes of sales concluded below 600/N CIF FE.

– In Greece there remains around 60,000 MT unsold. The Greek basis is always supported by having the large Turkish market on its doorstep, but the basis bid from this market has recently come under pressure. Interest is there at around 900/N FOT but ginners view this as a loss maker and seem prepared to carry this inventory through to new crop. However, with new crop interest ranging between 450-650/Z and basis pressure in the international market, it is hard to see this as a winning strategy.

– US job openings fell to 9.6 million in March. This is the lowest level since 2021 and indicates a cooling in the US labour market. This is not a bullish indicator for cotton!!

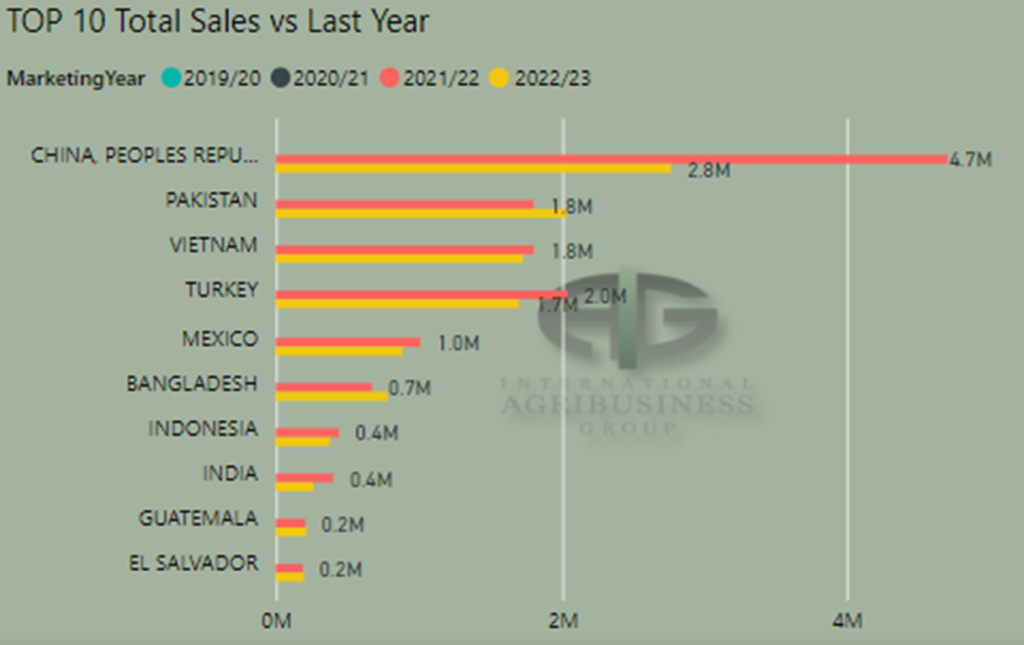

– The USDA export sales report for the week ending 27th April showed continuing solid sales and very impressive exports, which keep us online to reach and, quite possibly surpass, the USDA prediction of 12.2 million bales. Net sales of 231,300 bales were led by China with 117,100 bales and Vietnam with 43,500 bales. Both markets seemed very quiet over the reporting period, with Vietnam’s focus mainly being on the aggressive Brazil basis, so hats off to whoever “made” those sales. Strong exports of 414,000 bales were reported and the US seems to be maintaining the shipping pace required.

– The CFTC cotton on call report based on positions as of 28th April is now focused solely on July for the current crop positions. The July saw net 2,679 contracts fixed on the week and the net on call sales position now stands at 13,104 contracts, the 12th highest number for this week of the year.

– Taking a look to new crop, the net position is, in fact, negative 436 contracts. This is the only time we have seen overall new crop purchases outnumber sales in this week for the 23 years on record!!

Conclusion

EAP cannot rule out N23 making another attempt to fully fill the gap down to 74.85 and unfixed end users may choose to be scale down buyers of this contract from the high 70’s, down to the low 70’s were prices to get there. EAP expect a 75c to 85c/lb trading range to the end of the season ending 31st May with any moves outside of this range expected to be extremely short lived. For new crop, we would consider a scale down long from the mid 70’s only!

Useful links

*Please note that we only share CFTC CTO on weekend reports.

Written by:

Chris Williams

Copyright statement

No image or information display on this site may be reproduced, transmitted or copied (other than for the purposes of fair dealing, as defined in the Copyright Act 1968) without the express written permission of Earlam & Partners Ltd. Contravention is an infrigement of Copyright Act and its amendments and may be subject to legal action.

Disclaimer

The risk of loss associated with futures and options trading can be substantial. Opinions set forth herein should not be viewed as an offer or solicitation to buy, sell or otherwise trade futures, options or securities. All opinions and information contained in this email constitute EAP’s judgment as of the date of this document and are subject to change without notice. EAP and their respective directors and employees may effect or have effected a transaction for their own account in the investments referred to in the material contained herein before or after the material is published to any customer of a Group Company or may give advice to customers which may differ from or be inconsistent with the information and opinions contained herein. While the information contained herein was obtained from sources believed to be reliable, no Group Company accepts any liability whatsoever for any loss arising from any inaccuracy herein or from any use of this document or its contents. This document may not be reproduced, distributed or published in electronic, paper or other form for any purpose without the prior written consent of EAP. This email has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. For the customers of EAP, this email is produced exclusively for our business and expert clients, it is not for general distribution and our services are not available to private clients. Past performance is not indicative of future results.