- Ben Williams

- November 9, 2022

- 5:20 pm

- 5 min read

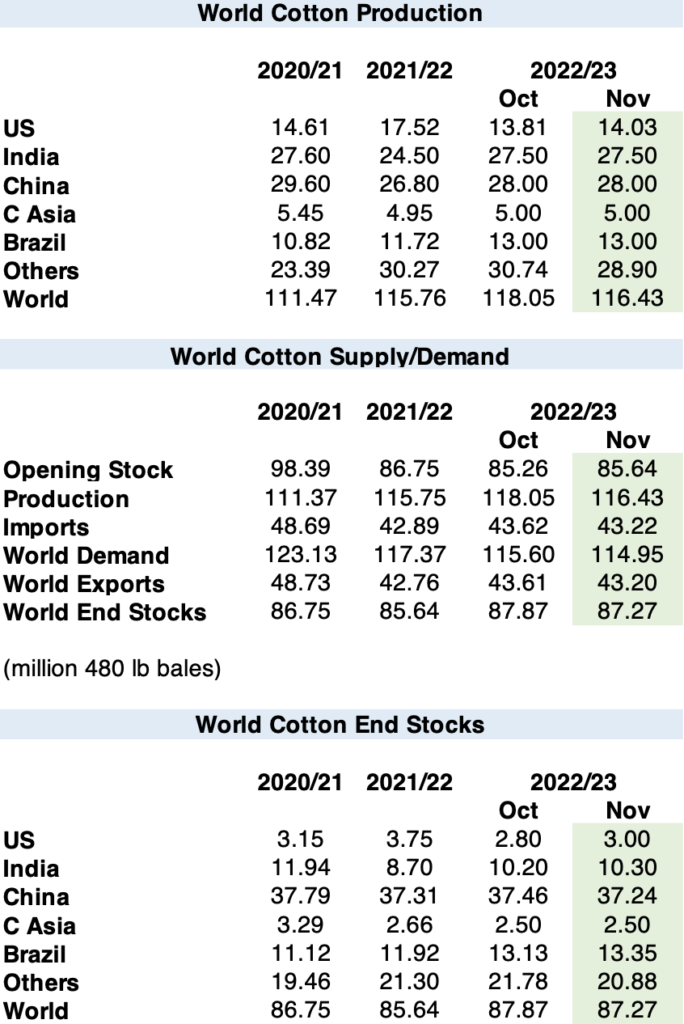

The 2022/23 U.S. cotton balance sheet shows slightly higher production and higher ending stocks this month. Production is 1.5 percent higher, at 14.0 million bales, as a decrease in the Southwest is more than offset by increases elsewhere. Domestic mill use and exports are unchanged, and ending stocks are 200,000 bales higher at 3.0 million bales or 20 percent of use. The 2022/23 season average price for upland cotton is reduced 5 cents this month to 85 cents per pound.

This month’s 2022/23 global cotton balance sheet includes lower production, consumption, trade and ending stocks. Production is down 1.6 million bales from last month, led by a 700,000-bale cut in Pakistan’s crop as gin arrivals there signal the extent of damage from earlier precipitation and flooding. Unusually high precipitation is also driving a 500,000-bale reduction in Australia’s 2022/23 crop, and in part accounts for a 630,000-bale decline in West Africa’s expected output. Global cotton consumption is projected 650,000 bales lower this month, with a 300,000-bale cut to mill use in both Pakistan and Bangladesh. World trade is 400,000 bales lower, with import reductions for Bangladesh and China only partly offset by Pakistan’s increase; West African exporters account for most of the decline in projected exports. At 87.3 million bales, world ending stocks in 2022/23 are projected 600,000 bales lower than in October, but 1.6 million higher than the year before.