- Jo Earlam

- April 11, 2023

- 10:14 am

- 5 min read

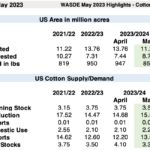

The 2022/23 U.S. cotton supply and demand forecasts show higher exports and lower ending stocks relative to last month, with production and domestic mill use unchanged. The export forecast is raised 200,000 bales, to 12.2 million, based on the pace of recent sales and shipments. Ending stocks are now forecast at 4.1 million bales, equivalent to 29 percent of total disappearance. The marketing year price received by upland cotton producers is projected to average 82 cents per pound, a decrease of 1 cent from last month.

In the global 2022/23 cotton balance sheet, higher production and reduced trade are contributing to higher ending stocks. World production is forecast 829,000 bales higher than in March as a 1-million-bale increase for China more than offsets a lower Brazilian crop. World 2022/23 ending stocks are projected 867,000 bales higher, with the largest increase in India, where projected stocks are 450,000 higher on lower exports. The expected volume of world trade in 2022/23 is 745,000 bales lower this month, with imports reduced for Bangladesh, China, and Turkey. On the export side, higher U.S. and Australia exports are more than offset by a 550,000-bale reduction for Brazil and a 400,000-bale reduction for India. Projected 2022/23 global consumption is 65,000 bales higher this month as a 500,000-bale increase for China more than offsets declines in Bangladesh and Turkey.